The FDA’s annual inventory came, and 37 innovative drugs were approved! The domestic new drug "going out to sea" was a success, and these two domestic pharmaceutical companies lit up.

Recently, the FDA released the annual report on new drugs in 2022. The data shows that the FDA approved 37 innovative drugs to be listed last year, with the number reaching a new low of nearly six years, of which nearly 50% have been listed in China or are in the review stage. The FDA promotes and speeds up the evaluation of new drugs in various ways through "multi-pronged approach". In 2022, a number of domestic innovative drugs "went out to sea" to break through the FDA, and the results were "mixed". Two domestic innovative drugs were approved by the FDA and four hit a wall.

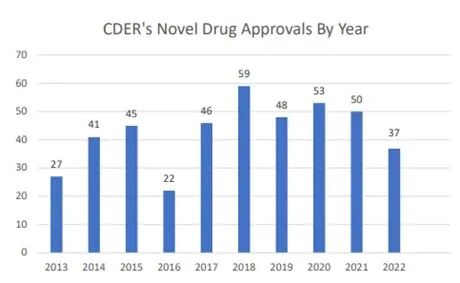

Figure 1: Number of new drugs approved by FDA in recent ten years

Source: FDA2022 Annual Report on New Drugs (New Drug Therapy Approvals 2022).

37 innovative drugs were approved, and 18 accelerated the entry into the China market.

Recently, the Center for Drug Evaluation and Research (CDER) of FDA released the annual report of new drugs in 2022. In 2022, the FDA approved the listing of 37 innovative drugs, with the number reaching a new low of nearly six years. Among the approved innovative drugs, 20 (54%) belong to "first-in-class" innovative drugs, and 20 (54%) are drugs for rare diseases.

As the benchmark of global pharmaceutical supervision, FDA has approved 28 new drugs (76%) in the first round, and 25 (68%) in the United States before other countries.

In 2022, FDA promoted and accelerated the evaluation of new drugs in various ways through "multi-pronged approach". Twelve (32%) were identified as fast-track, 13 (35%) were identified as breakthrough therapeutic drugs, 21 (57%) were identified as priority review, and 6 (16%) were accelerated for approval. CDER used one or more accelerated development and review methods for 24 (65%) of all new drugs approved in 2022.

Table 1: Innovative Drugs Approved by FDA in 2022

Source: FDA website, intranet database.

In recent years, more and more attention has been paid to innovative drugs in China. In 2022, innovative drugs approved in the United States are also running into the China market at "China speed" to solve the unmet health needs of more China patients. According to statistics, at present, 18 (49%) innovative drugs are at the stage of clinical application and above in China. Among them, four innovative drugs, namely, abcixinib, voronoxan, benvimod and pessolizumab, have been approved for marketing, while otconazole and deuterium colexitinib are in the application stage, while nine innovative drugs are in clinical phase III, one in clinical phase I and two in clinical application.

Table 2: Research and Development of Innovative Drugs in China

Source: Minenet database

Two domestic innovative drugs "went to sea" successfully, and legendary creatures actively expanded their territory.

In 2022, a number of domestic innovative drugs "went out to sea" broke through the FDA, and Sidakio Orense and Benvimod returned gratifying news and were successfully approved for listing.

On February 28th, 2022, the BCMA CAR-T drug Cedactylosin developed by Kingsley’s Legendary Biology was approved by FDA for the treatment of relapsed or refractory multiple myeloma. Cedactylosin became the first cell therapy product approved by FDA in China and the second CAR-T cell immunotherapy approved for BCMA in the world. This is a beautiful "turnaround" after the FDA announced the tightening of China’s listing policy for innovative drugs, which means that China has officially entered the world’s first-line position in the field of cell therapy.

After the successful listing in the United States, Sida Chiolense also extended its listing territory to the European Union and Japan in 2022. In May, 2022, the European Commission (EC) has granted conditional marketing permission to Cedactylosin for the treatment of adult patients with relapsed or refractory multiple myeloma who have received at least three treatments in the past, including immunomodulatory drugs, proteasome inhibitors and anti-CD38 antibodies, and the last treatment showed disease progression. In September, 2022, the Japanese Ministry of Health, Labor and Welfare approved Cedactylosin for the treatment of adult patients with recurrent or refractory multiple myeloma. At present, in China, Sida Chiolense is in the stage of applying for listing.

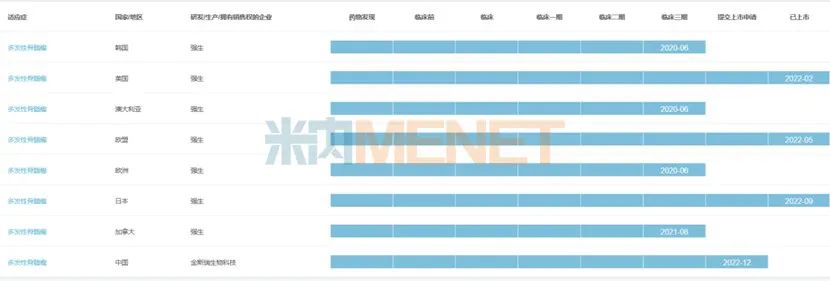

Figure 2: Global R&D progress of Sida Chiolense.

On May 24th, 2022, Dermavant Sciences announced that the FDA had approved the marketing of VTAMA (Benvimod, 1%) cream for the local treatment of adult plaque psoriasis. Benvimod, developed by Tianji Medicine, a domestic enterprise, is the first-in-class new drug with independent intellectual property rights.

In 2012, GSK obtained the overseas development right of Benvimod with a down payment of nearly $200 million. In July 2018, GSK announced that it would sell the overseas development right of Benvimod to Dermavant for $330 million.

As early as May 2019, Benvimod was approved to be listed in China as a "Class 1 new drug" for adults with mild to moderate stability psoriasis vulgaris suitable for local treatment. So far, benvimod is the first innovative drug approved by the FDA after it was approved for marketing in China.

Figure 3: Global listing of Benvimod

The road to "going out to sea" is not smooth. Cinda Bio and Junshi Bio … find another way out.

The road to "going out to sea" was not smooth sailing. In 2022, the innovative drugs of Cinda Bio, Junshi Bio, Hutchison Whampoa and Baekje Shenzhou all submitted their applications for listing in the FDA, but they were rejected by the FDA one after another.

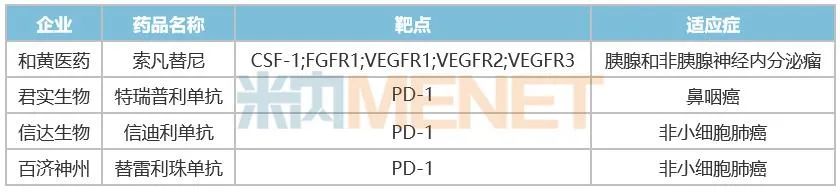

Table 3: Drugs not approved by FDA in 2022

In March, 2022, Cinda Bio announced that FDA refused to approve the listing application of new drugs for the first-line treatment of patients with non-squamous non-small cell lung cancer, including cindilizumab combined with pemetrexed and platinum chemotherapy. In its reply to Cinda Bio, FDA pointed out that the related product trials of Cinda Bio were only conducted in China, not global multi-center clinical trials, and the results were not applicable to patients in the United States due to the nature of a single country.

In May, 2022, Hutchison announced that the US FDA had not approved the application of Suo Fan tinib for the marketing of new drugs for the treatment of pancreatic and non-pancreatic neuroendocrine tumors. The reason for FDA’s rejection of Hutchison is similar to Cinda Bio’s. It thinks that the data package of Hutchison based on two successful China Phase III studies and an American bridging study is not enough to support the drug’s approval in the United States, and more international multi-center clinical trials representing American patients need to be included to support the approval in the United States.

In the same month, Junshi Bio’s application for the marketing of PD-1 antibody Treprilizumab received a complete reply from FDA, requesting a quality control process change. This process change was rejected because the facilities could not be inspected on site due to travel restrictions during COVID-19.

In July, 2022, Baekje Shenzhou announced that the FDA of the United States could not complete the required on-site verification work in China as scheduled due to travel restrictions related to the COVID-19 epidemic, so it would extend the completion time of the target review of the application for the new drug listing license for second-line esophageal squamous cell carcinoma. However, its partner Novartis revealed in the quarterly report that it had cancelled the listing application for the treatment of non-small cell lung cancer with tierellizumab in the United States.

In the face of the "ruthless" rejection of the FDA, Junshi Bio quickly made adjustment measures and resubmitted the application for the listing of Trepril monoclonal antibody to the US FDA. The FDA has set the date of PDUFA as December 23rd, 2022. Trepril monoclonal antibody is still in the approval stage, and there is no clear result. Hutchison Whampoa said that it is working with the FDA to evaluate the next step. Baekje Shenzhou is rumored to move to Europe, and it is expected that it will submit its first listing application in the EU in 2023. Cinda Bio announced at the end of the year that it had recovered the overseas rights and interests of Cindilizumab from its partner Lilly Pharmaceutical.

There are many cases of domestic innovative drugs failing to go to sea. On the one hand, FDA has high requirements for domestic pharmaceutical companies’ products going to sea. According to the FDA’s previous requirements for Cinda Bio, if the new PD-1 wants to be listed in the United States, it needs to compete with the existing standard therapies. And drug K has been approved for dozens of indications in the United States, and products with the same indications have to cross the mountain of drug K if they want to be approved. On the other hand, at present, how to conduct clinical trials of domestic innovative drugs overseas is still in the exploratory stage. These failed cases essentially reflect the doubts of foreign mature markets on the quality of clinical trials in China.

tag

2022 has passed, and the innovative drugs approved by FDA are the direction of global innovative drug research and development trends, leading the way for innovative pharmaceutical companies. For domestic innovative pharmaceutical companies, if they want their products to go abroad, there is no doubt that they should sum up their previous experience in innovating drugs in the FDA, always pay attention to the changes in the clinical pattern, and keep in touch with the FDA for clinical design. At the same time, we should improve our products from many dimensions, such as reflecting the innovation of products, meeting unmet clinical needs, improving drug accessibility, improving technology, selecting indications, and improving safety and efficacy.

Source: Minenet comprehensive database.

This article is an original manuscript, please indicate the source and author, otherwise the tort liability will be investigated.