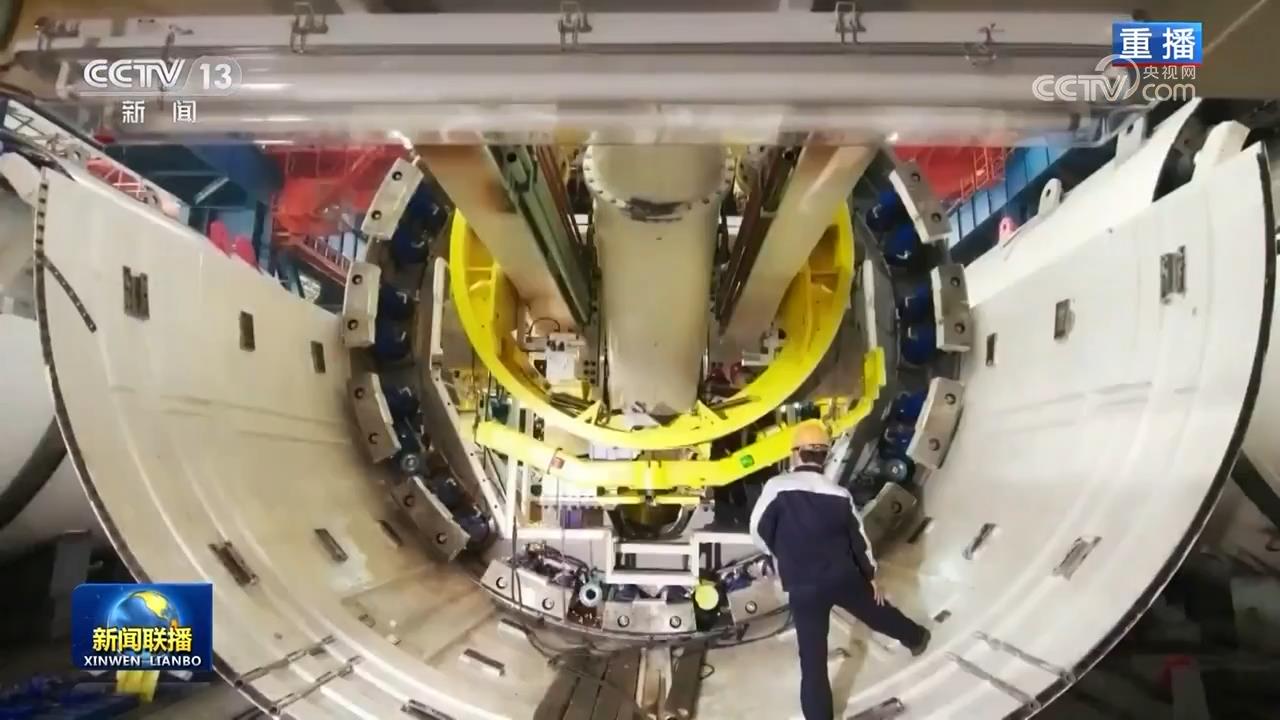

At present, the domestic air cargo volume has increased sharply, and the competition has also intensified. The data shows that in the six years from 2010 to 2015, China’s civil aviation cargo volume increased by 12%, but the freight rate decreased by 27%. In 2015, the average freight price of the three major airlines (China Eastern Airlines, China Southern Airlines and Air China) was only 1.27 yuan/ton-km, with little profit margin.

In this context, the mixed reform and transformation of freight has explored a new way out for air freight.

(The data picture comes from the network)

(The data picture comes from the network) On June 19th, the signing ceremony of China Eastern Airlines Logistics Mixed Reform Agreement was held in Shanghai. At this point, the long-rumored China Eastern Airlines logistics mixed reform plan has finally been settled, and the first batch of "seven major areas" mixed ownership reform pilots promoted by the state have been completed in the civil aviation field.

Lin Zhijie, an expert in the civil aviation industry, said that in the future, the air freight of the three major airlines will extend upstream and downstream, and the air freight will be transformed into an integrated logistics provider.

A China Eastern Airlines takes the lead in "eating crabs"

"Even my life is on the line." On June 19th, it was raining heavily in Shanghai. At the Shanghai International Airport Hotel, Liu Shaoyong, the chairman of China Eastern Airlines Co., Ltd., talked about the course of China Eastern Airlines’ mixed logistics reform in recent years.

It made its first profit in 2014, spun off from China Eastern Airlines in 2016, and became the first state-owned air transport enterprise to carry out mixed reform in 2017. Open the timeline of China Eastern Logistics in recent years, and every step of its progress is breaking away from the strange situation of "ten years and nine losses" in the field of aviation logistics. Back a few years ago, China Eastern Airlines logistics freight business accounted for a low proportion of the overall operating income of China Eastern Airlines, and showed a downward trend. With the decline of the global freight market, mainstream international airlines began to gradually withdraw or reduce their all-cargo business.

On the other hand, private express delivery companies are also eyeing the field of aviation logistics. Thanks to the development of cross-border e-commerce and consumption upgrading, logistics products have started to be high-end this year, and the requirements for timeliness are getting higher and higher. Air logistics has gradually become a battleground for private express delivery companies such as Yuantong, SF Express and Shentong.

On June 19, 2017, China Eastern Airlines Group held a press conference, announcing that its China Eastern Airlines Logistics will introduce four new shareholders, and China Eastern Airlines became the first state-owned air transport enterprise to carry out mixed reform. After the mixed reform, Legend Holdings Co., Ltd. (hereinafter referred to as Legend Holdings), Prologis Investment (Shanghai) Co., Ltd. (hereinafter referred to as Prologis), Debon Logistics Co., Ltd. (hereinafter referred to as Debon), Greenland Financial Investment Holding Group Co., Ltd. (hereinafter referred to as Greenland) and the core employees of China Eastern Airlines Logistics will become the new shareholders of China Eastern Airlines Logistics, which will hold 45%, 25%, 10% and 10% respectively.

The mixed reform of "brewing for four years" and "talking about more than 100 companies" has turned China Eastern Airlines Logistics, once in deep crisis, into the darling of capital.

"In fact, China Eastern Logistics has been exploring the reform of mixed ownership since four years ago," Li Jiupeng, general manager of China Eastern Logistics, revealed that China Eastern Logistics has started the transformation strategy of "integration of heaven and earth" since 2012. "Later, due to one reason or another, it has not been made, but we have already had such preparations and ideas. Today, the right time and the right place are in harmony, and the opportunity has come." Li Jiupeng said.

At present, China Eastern Airlines Logistics, which has achieved continuous profit for three years, has become the first state-owned air transport enterprise in China’s civil aviation industry to transform into a modern air logistics service integrator. It is on the basis of the transformation of China Eastern Airlines Logistics that in September 2016, the state made clear the first batch of "6+1" pilot list of mixed ownership reform, and China Eastern Airlines Logistics became the first pilot enterprise in the civil aviation field to carry out mixed reform. "In the past, we lost money and began to make profits in 2014. After making profits, we began to encounter a development bottleneck. We very much hope to use this reform to form new competitiveness and truly develop further in the market." Li Jiupeng said frankly.

It is reported that in the stage of discussing the mixed reform plan, the shareholders put forward very harsh conditions, requiring the management to hold shares, and the shareholding ratio should reach a certain proportion. In addition, now the executives hold shares to buy shares of the company with their own funds, so, "Liu Zong (Liu Shaoyong) said ‘ It is equivalent to executives tying their lives to the enterprise ’ That’s right. " Li Jiupeng said.

B looking for the best logistics matching enterprise

The author noticed that in this mixed reform scheme, logistics real estate developer Pross and Debon Logistics appeared together.

In this regard, Li Jiupeng said that the enterprises such as Legend Holdings, ProLogis, Debon, Greenland, etc., which have acquired shares this time, have strong strengths in their respective fields and can form complementary resources and coordinated development with China Eastern Airlines Logistics.

It is worth noting that in this mixed reform scheme, China Eastern Airlines Group gave up its absolute control, holding 45% of the shares, and the other 55% of the shares were held by the core employees of Legend Holdings, Greenland Group, ProLogis, Debon Logistics and China Eastern Airlines Logistics. "The mixed reform of China Eastern Logistics hopes to achieve the real reform goal, establish a market-oriented mechanism system and enhance the vitality of enterprises. In the equity market, many private capitals hope to take a certain proportion of shares in China Eastern Airlines Logistics. This time, China Eastern Logistics did not insist on 51% control like some previous state-owned enterprises, mainly because it wanted to let more private capital enter. "

In the end, China Eastern Airlines selected Legend Holdings, Prologis, Debon and Greenland Group as strategic partners, and the selection criteria were that these enterprises were in the leading position in the industry, and they had complementary resources with China Eastern Airlines, which could produce synergistic effects. Li Jiupeng introduced that among the four investors, Lenovo, Pross and Debon belong to strategic investors, while Greenland Group belongs to financial investors. The four investors of China Eastern Airlines Logistics are excellent enterprises in their respective fields, and the four enterprises have different characteristics, which can match the development of China Eastern Airlines Logistics, have complementary advantages with China Eastern Airlines Logistics, and have strategic synergy with China Eastern Airlines Logistics. The four companies are involved in third-party logistics solutions, express delivery service providers, finance, logistics real estate and other aspects, which will greatly help the future development of China Eastern Airlines logistics.

Among these three strategic partners, Pross and Debon undoubtedly have the highest matching degree with the existing business of China Eastern Airlines Logistics. Cui Weixing, chairman of Debon Logistics, said that China Eastern Logistics and Debon are very complementary. "China Eastern Airlines has many planes, and we have many cars." It is reported that China Eastern Logistics now has nine all-cargo planes and the third cargo airport in the world — — The cargo terminal of Pudong Airport and the belly cabin of 572 passenger planes of China Eastern Airlines have the agency right, and Debon Logistics currently has more than 120,000 employees, which can have a synergistic effect with China Eastern Airlines Logistics in terms of ground distribution, organization of goods supply and network expansion. "We will make good use of the abdominal cabin resources of China Eastern Airlines Logistics. There were many successful cases before the efficient use of abdominal cabins, such as DHL. We are all actively studying and we will fully adapt to China Eastern Airlines. " Cui Weixing said.

As another investor’s representative, Dong Fang Hao, chief strategy officer of Prologis China District, said that in China Airport, the airport resources of China Eastern Airlines are undoubtedly scarce and precious, and China Eastern Airlines Logistics has a very good cross-border aviation network. Prologis has a global logistics facility portfolio of 55 million square meters, and owns and manages 252 comprehensive logistics parks and industrial parks in 38 major domestic markets. The cooperation between the two can produce the core competitiveness of cross-border e-commerce logistics platform based on air cargo terminal services, supported by supervised warehouses and value-added warehouses, and extended by cross-border e-commerce special supervision areas and logistics real estate, and enhance the agglomeration effect of aviation logistics industry. "Lenovo is now very concerned about the modern service industry, and logistics is a very important part of the service industry," said Liu Chuanzhi, chairman of Legend Holdings Limited. After becoming a strategic investor in China Eastern Logistics, Legend Holdings will provide high-end logistics solutions to China Eastern Logistics. "Because aviation is high-end logistics, high-end logistics solutions have a lot of fit with Lenovo." Li Jiupeng said.

Li Jiupeng revealed that in the process of finding partners, China Eastern Logistics also contacted SF, but soon found that SF wanted to build an "I-oriented" ecosystem, which did not match the needs of China Eastern Logistics, because China Eastern Logistics also wanted to build an "I-oriented" system, and the goals of both parties were in conflict. China Eastern Logistics then turned to look for other options that respect China Eastern Logistics. Li Jiupeng said that China Eastern Logistics has not closed the door to cooperation with other enterprises. "In fact, today, whether it is SF Express or not, ‘ Three links and one access ’ Whether it’s China Post or all enterprises in the logistics field or other fields, we are all cooperating. However, when we choose partners for specific projects, we will focus on the enterprises that participate in equity investment this time, but this does not mean that we are incompatible with others. "

Last stand under the bottleneck of C freight transportation

In 2016, the performance of the three major airlines hit a new high in six years. In sharp contrast, air cargo companies have failed many times in transformation and are falling into a situation of "ten years and nine losses".

Bottlenecks of freight companies are common in the three major airlines. According to the statistics of Huatai Securities, taking Air China as an example, in 2016, freight turnover and revenue accounted for less than 10% of the company. Although in recent years, the air cargo business has basically turned losses into profits by reducing costs and increasing efficiency, mainly by adjusting aircraft types, and the oil price is at a low level, the leading company in the industry — — The cargo and mail carrying rate of the three major airlines is still less than 55%, and the freight rate is only about 1.2 yuan/ton-km.

"The original business model of freight companies has completely failed to meet the consumption needs of the logistics industry," said Li Xiaojin, a senior civil aviation expert. From the perspective of foreign airlines, whether Singapore Airlines or Cathay Pacific, American Airlines or Delta Air Lines, the freight business of these airlines has always been positioned as an auxiliary product of airlines, and it has increasingly become a contradictory product; On the other hand, FedEx, which does air logistics by buying planes, has a smooth transformation and development. It can be seen that there is no successful case of specializing in air freight itself, and only when it is transformed into express delivery can it develop well.

It is understood that the three major airlines have obvious differences in the operational and organizational forms of air cargo. Compared with China Eastern Airlines, Air China’s freight business is mainly handled by Air China, a joint venture company, and China Southern Airlines’ freight is handled by the freight department. Generally speaking, the mixed reform of civil aviation logistics has been imminent.

On March 28th, 2017, China Southern Airlines officially signed the Framework Agreement, Share Subscription Agreement and a series of business cooperation agreements with American Airlines in Guangzhou. According to the agreement, American Airlines will invest $200 million in China Southern Airlines to subscribe for the H shares to be issued by China Southern Airlines.

On April 21st of the same year, Air China announced that it would start the reform of mixed ownership of air cargo logistics. It was reported that Air China would reorganize the cargo business of Air China and China Southern Airlines on the platform of China International Cargo Airlines Co., Ltd., and at the same time mix with the express logistics enterprises such as Sinotrans Changhang Group, Shunfeng Express and YTO Express under China Merchants to form a new China cargo airline.

It can be seen that the competition of air freight will become increasingly fierce with the mixed reform in full swing.

In the view of China Eastern Airlines Group, China Eastern Airlines’ logistics mixed reform is an attempt of national mixed reform, which also meets the group’s own needs. According to the idea of China Eastern Airlines Group, through the mixed reform of China Eastern Airlines Logistics, the world’s leading aviation logistics industry ecosystem will be gradually improved and built. "China Eastern Airlines Logistics will become a world-class aviation logistics national team comparable to FedEx, UPS and DHL, and explore the path for the reform of state-owned enterprises and accumulate replicable and scalable reform experience." Liu Shaoyong said at the press conference.

D people look forward to deep integration

In fact, before China Eastern Airlines announced the mixed reform plan of China Eastern Airlines Logistics, the mixed reform plan of China Airlines Group (hereinafter referred to as AVIC) for its freight business was also approved. Earlier, China Southern Airlines Group was also included in the mixed reform.

This "fragmented" situation seems to have actually announced that the regulatory authorities have at least temporarily abandoned the plan to integrate the freight business of state-owned airlines.

On April 22, China International Airlines Co., Ltd. announced that it had received a notice from AVIC that the National Development and Reform Commission had approved the latter’s request for "mixed reform" of its air cargo logistics business.

However, according to a privately circulated mixed reform plan of AVIC, it is proposed that China International Cargo Airlines Co., Ltd. will be used as a platform to reorganize the freight business of Air China and China Southern Airlines Co., Ltd., and at the same time, it will be mixed with the express logistics enterprises such as Sinotrans Changhang Group, SF Express and YTO Express to form a new Chinese freight airline.

Air China, on the other hand, did not comment on this plan, and said in the announcement that AVIC Group has not drawn up any concrete plan for the above-mentioned "mixed reform" and has not reached any relevant agreement or arrangement with any party.

"In fact, the initial idea of freight restructuring of state-owned airlines is more radical. The high-level opinion is that all the resources and related businesses of state-owned freight airlines are allocated to the business section of a private logistics enterprise, which will be managed and operated in a unified way," a person familiar with the matter revealed in an interview. "However, because of various factors, this idea is difficult to implement, so there may be other ideas, including the previously circulated plan of mixed freight reform of AVIC Group."

Some media reporters had previously interviewed Yu Weijiao, chairman and president of YTO Express, one of the parties rumored to be involved in the mixed reform of Air China freight. He said: "At present, there are two main obstacles for Yuantong to participate in the mixed reform. One is pure financial investment; Then there is no business matching, and even in many business cooperation requirements, it is higher than cooperation with other companies outside. "

In fact, under the trend that the mode of logistics industry is becoming more and more systematic, industrial chain and ecological circle, no matter the state-owned cargo aviation enterprises, private logistics enterprises or even the upstream and downstream related enterprises, they can’t get rid of the powerful role of the whole industrial chain in their own development, which is also an important reason why China Eastern Airlines Group is willing to open to private and foreign-funded enterprises such as Debon, which is good at road less-than-truckload express, and Prologis, which is a warehousing company, when reorganizing its logistics sector business.

According to China Eastern Airlines Group’s conception of logistics business, the third-party logistics, logistics real estate, cross-border e-commerce and traditional express delivery functions of private capital will be integrated on the basis of aviation logistics and freight industry, so that the integration of state-owned and non-state-owned capital is not only a means, but the real purpose is the deep integration of business.

This is also the biggest motivation for private enterprises to be willing to participate in the mixed reform. As Yu Weijiao said, "We hope to cooperate more with airlines to reduce costs with their resources, and cooperate with the development of domestic and foreign business to make full use of the airline’s abdominal cabin resources, so that we don’t have to buy so many planes ourselves."

"I hope that state-owned airlines can cooperate with us with a more open attitude and let us really participate in it to achieve a win-win situation." Yu Wei said.

Transfer from: China Water Transport News

[Copyright and Disclaimer] All copyrighted works belonging to this website must be authorized to reprint and indicate the source of "China Industrial Economic Information Network". Otherwise, this website will reserve the right to pursue its relevant legal responsibilities. Reprinted articles and corporate publicity information only represent the author’s personal views, not the views and positions of this website. Please contact: 010-65363056 for copyright matters.

Extended reading