Kelu Electronics (002121.SZ), which planned to change hands, quickly found the takeover party.

Kelu Electronics announced on the evening of May 23rd that it intends to raise no more than 1.386 billion yuan from Midea Group (000333.SZ) in its non-public offering of shares. After the issuance, Midea Group will take over from Shenzhen Capital Operation Group Co., Ltd. (hereinafter referred to as "Shenzhen Capital Group") and become the controlling shareholder of Kelu Electronics.

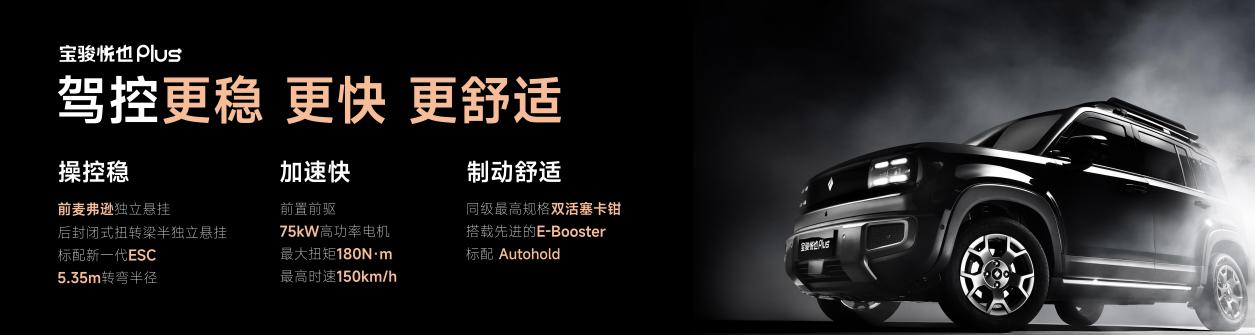

Midea Group’s total increase in Kelu Electronics in 2022 is mainly due to the consideration of overweight energy management and energy storage industry. The home appliance giant with a market value of 370 billion entered the house, and the market sentiment responded enthusiastically. On May 24th and 25th, Kelu Electronics (002121.SZ) won the daily limit for two consecutive days, and its share price rose from 4.13 yuan/share before suspension to 4.99 yuan/share.

However, from the current point of view, the subscribed Kelu Electronics has a poor color, which not only has sustained losses in the past five years, but also accumulated as high as 4.064 billion, and the debt ratio remains high.

In this regard, in Midea’s group stock bar, there are many complaints from minority shareholders: "The acquisition of Kelu Electronics is pure love, knowing that the next winter is still a loss-making garbage?" "Why don’t you spend more money to buy back your own stock and cancel it?" "What company vision! Bad reviews should deduct the management KPI. "

In the secondary market, on May 24th and 25th, Midea Group closed down for two consecutive days. As of May 25th, the closing price was 53.4 yuan/share, with a market value of 373.6 billion yuan.

The insiders believe that in the context of the household appliance industry entering the stock market, giants need diversified development, and new energy is one of the high-quality tracks.

Midea’s sweeping increase, taking over the Shenzhen SASAC.

Kelu Electronics’ plan for non-public offering of A shares in 2022 involves three companies.

First of all, Midea Group signed an agreement with Kelu Electronics to fully subscribe for the company’s 2022 non-public offering of shares in cash, and the number of shares issued shall not exceed 30% of the company’s total share capital before this issuance, that is, no more than 423 million shares (inclusive). The issue price of this non-public offering of shares is 3.28 yuan/share, and the total amount of funds to be raised does not exceed 1.386 billion yuan.

Midea Group not only covered the fixed increase of Kelu Electronics in 2022, but also signed an agreement with Shenzhen Capital Group, the controlling shareholder of Kelu Electronics, which intends to transfer its 126 million shares of Kelu Electronics (accounting for 8.95% of the company’s total share capital on the date of signing the agreement) to Midea Group at a price agreement of RMB 6.64 per share. In addition, Shenzhen Capital Group has the right to choose to continue to transfer some of its shares to Midea Group at the same price.

As of the announcement date, Shenzhen Capital Group holds 342 million shares of Kelu Electronics, with a shareholding ratio of 24.26%. According to the upper limit of the issuance, Midea Group will hold 29.96% of the shares and voting rights of Kelu Electronics, the controlling shareholder of the company will be changed from Shenzhen Capital Group to Midea Group, and the actual controller of the company will be changed to He Xiangjian, the actual controller of Midea Group. However, the shareholding ratio of Shenzhen Capital Group became 11.78%, relegating to the second largest shareholder.

Image source: Kelu Electronic Announcement

According to public information, Kelu Electronics was founded in 1996 and listed on the Shenzhen Small and Medium-sized Board in 2007. Rao Lu Hua, its founder and former actual controller, was listed on the Hurun Rich List in 2018 for 3.9 billion yuan.

In August 2018, Shenzhen Capital Group began to invest in Kelu Electronics. Shenzhen Capital Group, wholly owned by Shenzhen State-owned Assets Supervision and Administration Commission, is a state-owned auxiliary performance platform and a professional platform for state-owned capital operation specially established in Shenzhen. Its main businesses are mergers and acquisitions, equity investment, industrial funds and market value management.

On June 19th, 2019, after Shenzhen Capital Group increased its holdings by 1,012,900 shares through centralized bidding, its total shareholding reached 24.26%, surpassing Rao Lu Hua, the original actual controller of the company, and became the largest shareholder.

In May 2021, almost all of Rao Lu Hua’s shares in Kelu Electronics were pledged and frozen, and he gave up control of the company. On June 5 of the same year, the controlling shareholder and actual controller of Kelu Electronics were officially changed to Shenzhen Capital Group.

Originally, Shenzhen SASAC intends to continue to hold Kelu Electronics. On December 29, 2021, Kelu Electronics released the plan for the non-public offering of A shares in 2021. At that time, Shenzhen Capital Group planned to participate in the issuance and subscription with no more than 540 million yuan in cash.

However, just as Kelu Electronics announced the non-public offering of A shares in 2022, it also announced the termination of the non-public offering of shares in 2021, and reached an agreement with Shenzhen Capital Group to terminate the original Share Subscription Agreement. According to the agreement of equity transfer price, Midea Group needs to pay 837 million yuan to Shenzhen SASAC to acquire 126 million shares, adding 1.386 billion yuan, and Midea may spend at least 2.223 billion yuan to gain control of Kelu Electronics.

"Arm wrestling" with Gree

In recent years, Kelu Electronics has poor management and high asset-liability ratio, and has continued to lose money since 2017.

From 2017 to 2019, Kelu Electronics deducted non-net profit of-122 million yuan,-1.241 billion yuan and-1.781 billion yuan respectively, down by 283.07%, 919.96% and 43.48% year-on-year. From 2020 to 2021, Kelu Electronics still lost money, but the range narrowed, and the non-net profit deducted was-320 million yuan and-600 million yuan respectively.

From 2017 to 2021, Kelu Electronics accumulated losses as high as 4.064 billion yuan. What does Midea Group take a fancy to Kelu Electronics?

Midea Group said that Kelu Electronics, as a leading integrated service provider in the energy field in China, has a solid technical foundation and market foundation, and has great development potential. Midea Group hopes to gain control of Kelu Electronics based on its good development prospects and the vision of promoting the development of China’s new energy industry.

Midea also said that with the further development of national energy transformation and power system reform, under the goal of "double carbon", the new power system with new energy as the main body will be the core component of the future energy system.

In fact, in the field of new energy, Gree Electric (000651.SZ), as one of the "home appliances giants", has already run ahead.

In 2016, Dong Mingzhu invested RMB 1 billion from his own pocket as a natural person in Zhuhai Yinlong New Energy Co., Ltd. (hereinafter referred to as "Zhuhai Yinlong"). Zhuhai Yinlong is mainly engaged in the research, development, production and sales of lithium titanate materials, lithium titanate power batteries, core components of electric vehicles, complete electric vehicles and charging equipment for electric vehicles. In recent years, it has developed rapidly in the new energy industry and electric vehicle industry.

By August, 2021, through judicial auction in Gree Electric and the voting rights corresponding to the equity entrusted by Dong Mingzhu, Gree Electric totally controlled 47.93% of the voting rights of Yinlong New Energy (formerly Zhuhai Yinlong) and officially obtained the control rights of Yinlong New Energy.

At that time, Gree Electric said that through the core technology of lithium titanate battery mastered by Yinlong New Energy, Gree could quickly cut into the field of new energy electric vehicles and, more importantly, make great achievements in the energy storage business. Compared with the stock competition in the home appliance market, the energy storage business in the trillion market will be a new kinetic energy for Gree’s growth.

In November 2021, Gree acquired a 29.48% stake in Dunan Environment (002011. SZ), a leading enterprise in the global refrigeration component industry.

Relatively speaking, Midea He Xiangjian entered the new energy track late.

On February 16th this year, the signing and foundation laying ceremony of the new strategic base for new energy auto parts of Anqing Weiling Auto Parts Co., Ltd., a subsidiary of Midea Group, was held in Anhui. It is reported that the total investment of the project is about 11 billion yuan, of which the investment in fixed assets is about 6.5 billion yuan, which is one of the largest projects invested by Midea Group.

The business related to new energy vehicles is a major direction for Midea Group in the future. In order to cooperate with the strategic adjustment, Midea Group has previously made a number of mergers and acquisitions.

In March 2020, Midea acquired 18.73% of the shares of Hekang Xinneng for 743 million yuan. The company has the industrial chain business of new energy vehicles and their charging piles; In December 2020, Midea acquired Hitachi compressor in Thailand and incorporated it into the unified management of the group’s electromechanical business group; In February, 2022, the groundbreaking ceremony for the new strategic base of new energy auto parts of its subsidiary Anqing Weiling Auto Parts Co., Ltd. was held in Anhui, with a total investment of 11 billion yuan.

However, Liu Buchen, a senior observer in the home appliance industry, said that these actions of Midea involve the driving motor and auxiliary driving of new energy vehicles, not energy.

"The acquisition of Kelu Electronics by Midea is mainly for the layout of smart grid, new energy and comprehensive energy service tracks. On the sooner or later, Gree comes first. Midea had basically no layout in the new energy track before, starting with the acquisition of Kelu Electronics. " Liu Buchen told Time Finance.

According to public information, Kelu Electronics’ core business is smart grid business, and it is the mainstream supplier of State Grid and China Southern Power Grid. At the same time, Kelu Electronics is also one of the earliest enterprises in China to enter the field of energy storage system integration, and also carries out new energy business including energy storage business, new energy vehicle charging and operation business, and comprehensive energy services.

The home appliance giant with a market value of 370 billion entered the house, and the market sentiment responded enthusiastically. On May 24, Kelu Electronics had a daily limit within a few minutes after the opening, and sealed the daily limit until the close. On May 25th, Kelu Electronics continued its upward trend, winning a word board and closing at 4.99 yuan/share.

On the same day, Time Finance called Kelu Electronic Securities Department, and its staff said that the non-public offering plan was only a pre-plan at present, and it was still in the initial stage, and it would take some time before it landed. The specific landing plan involved many departments and had to be approved by the CSRC.

However, the shareholders of Midea Group do not buy it. In Midea’s group stock bar, there are many complaints from minority shareholders: "Buying Kelu Electronics is pure love, knowing that it will be a cold winter and buying a loss-making garbage?" "Why don’t you spend more money to buy back your own stock and cancel it?" "What company vision! Bad reviews should deduct the management KPI. "

On May 25th, Midea Group fell slightly by 0.73% to 53.4 yuan/share. Regarding the acquisition of Kelu Electronics, Time Finance called Midea Group for an interview, but as of press time, he could not get through.