China Fund News, Amman

On the morning of the 30th, the market switched high and low. Huawei’s concept stock stalled, and funds continued to flow to the worst track in the past two years, semiconductors and pharmaceuticals.

From the news perspective, Sino-US relations have been stable and improving recently, and rumors have further opened up the space for cooperation in the semiconductor and pharmaceutical fields, which has made the above two sectors continue to strengthen since last Friday.

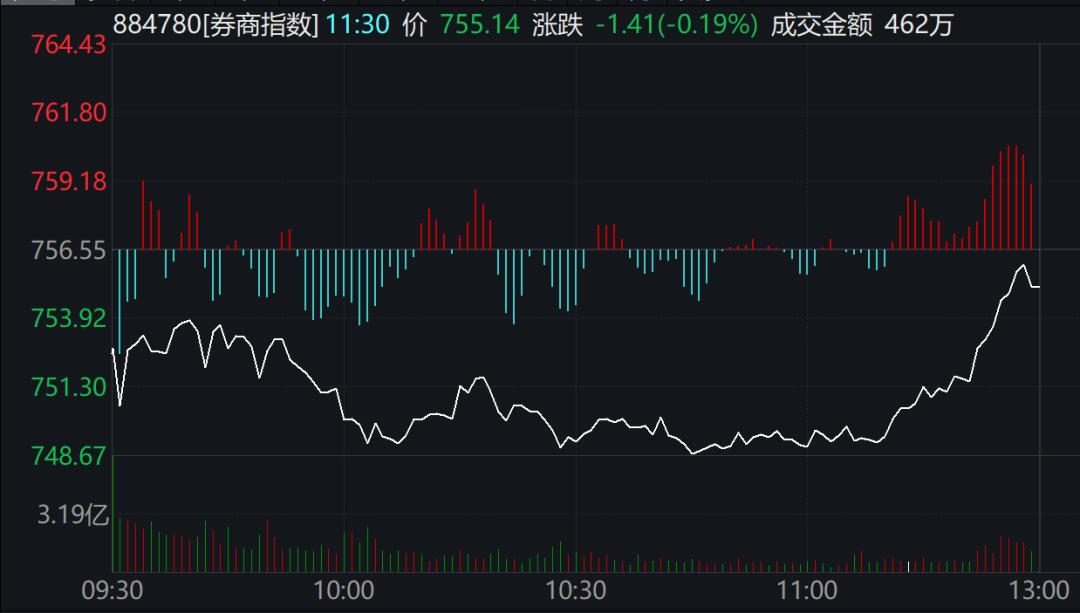

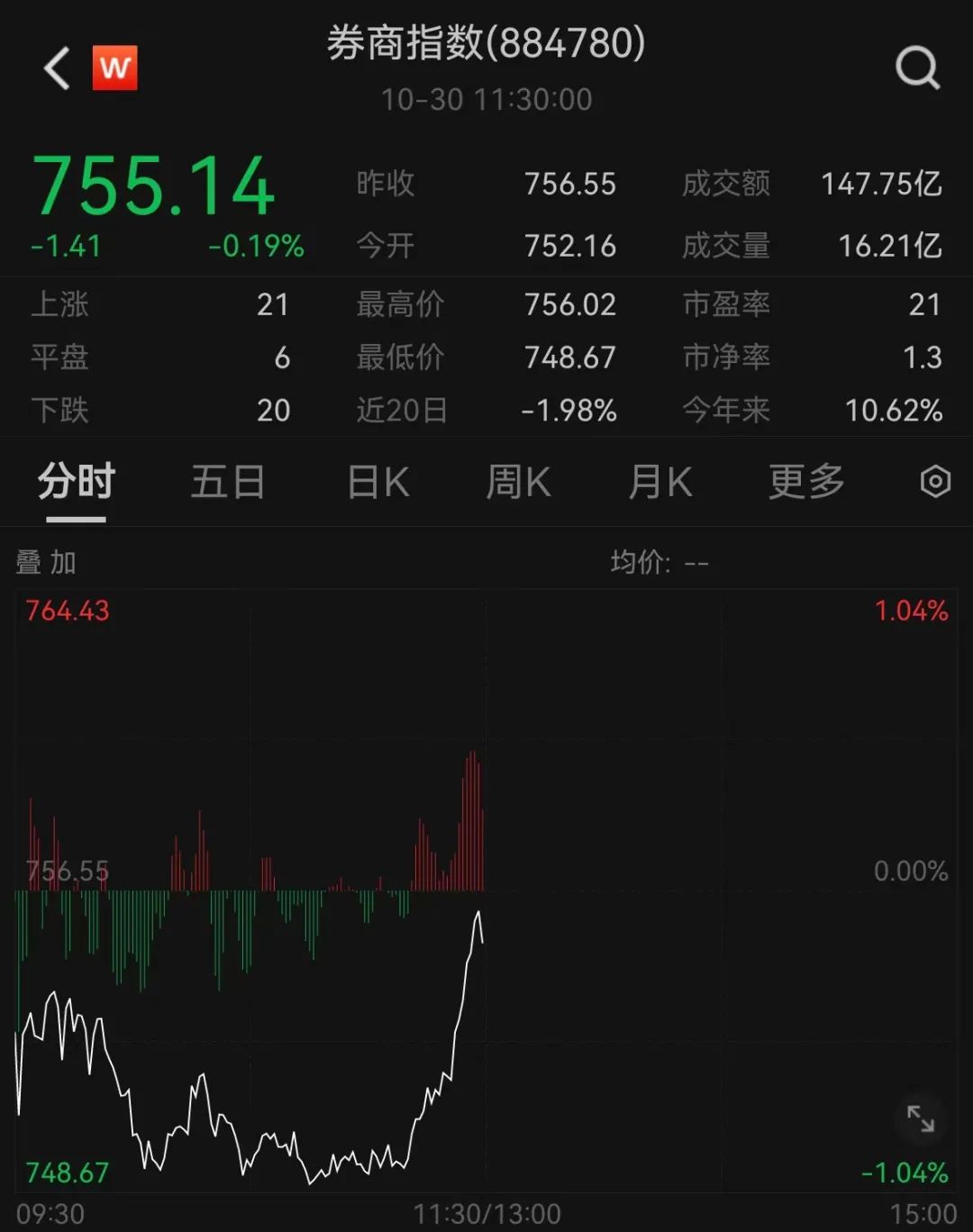

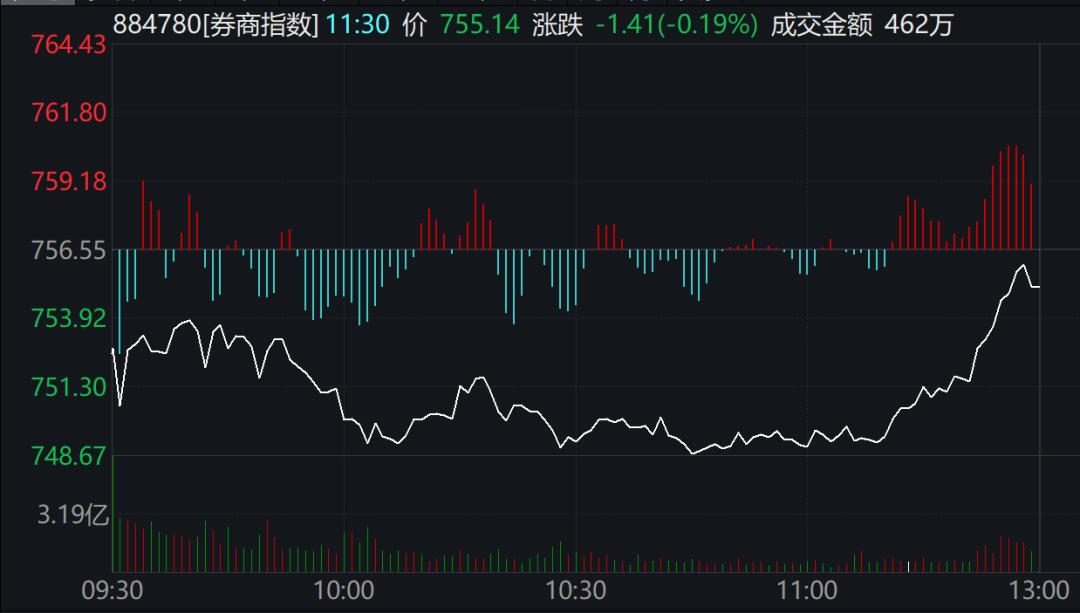

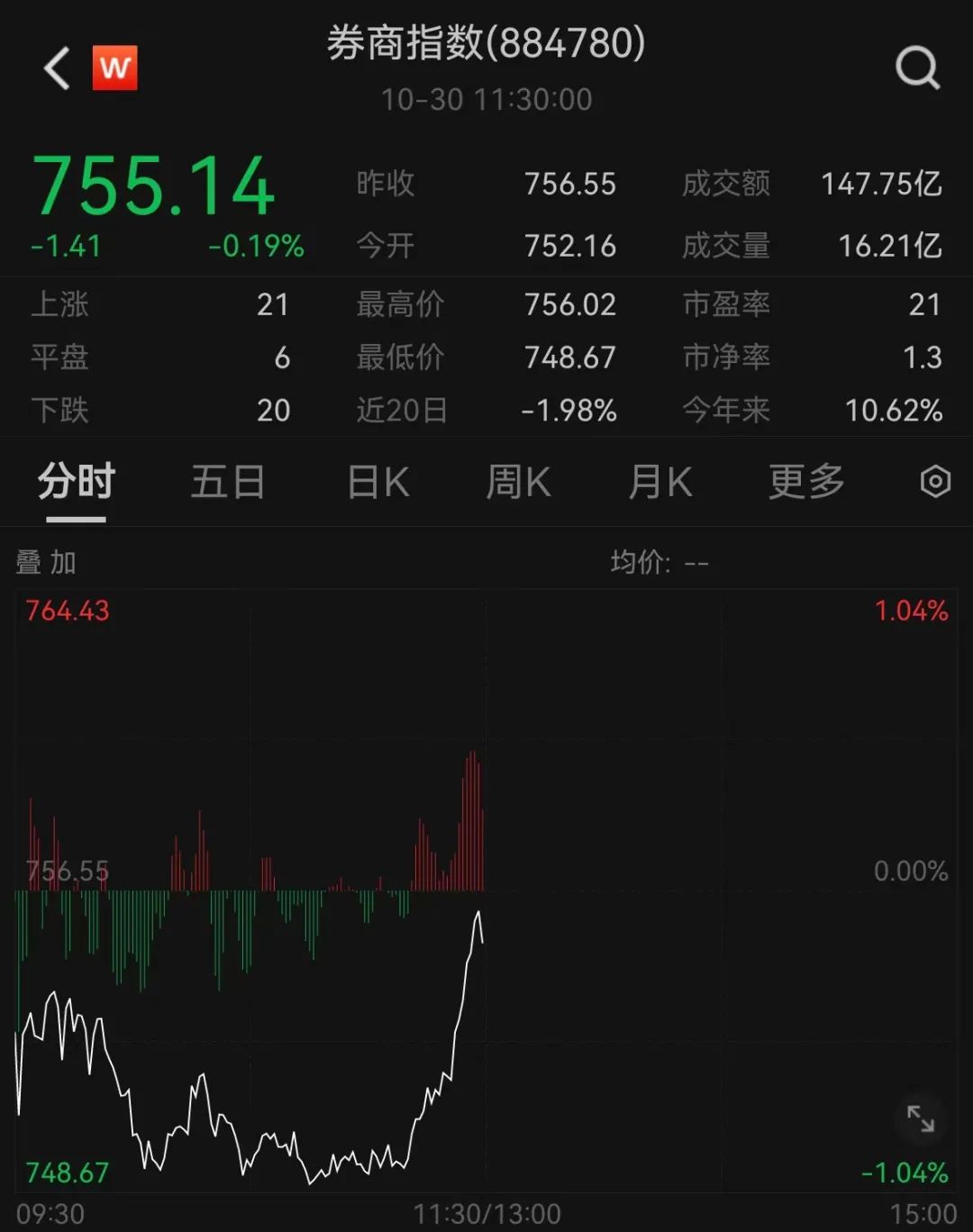

Combined with the above factors, 30 early trading, the growth enterprises market rose more than 2%, the Shenzhen index also rose more than 1%, brokerages, banks because the third quarter performance is not as expected, led the Shanghai index fell as a whole. However, near midday, brokerage stocks suddenly rose, the Shanghai index also eventually turned red.

As of the noon close, the Shanghai index rose 0.17%, the Shenzhen index rose 1.53%, growth enterprises market index rose 2.33%. In terms of northbound funds, the Shanghai stock connect early net outflow 1.034 billion, Shenzhen stock connect early net inflow 1.714 billion.

Let’s take a look at the details:

Bull market flag bearer suddenly jerks

Near midday on the 30th, the brokerage sector, which had been lower in early trading, suddenly rose. Huaxin shares rose more than 6%, and Capital Securities and Harbin Investment shares rose.

On the news, Huaxin shares released a third-quarter report on October 28, saying that the net profit attributable to the owner of the parent company in the third quarter of 2023 was 249 million yuan, an increase of 397.31% year-on-year; the operating income was 500 million yuan, a decrease of 19.6% year-on-year.

The more active brokerage sector Pacific turned losses into profits. The company achieved a net profit attributable to shareholders of listed companies of 251 million yuan in the first three quarters, compared with -64 million yuan in the same period last year. Pacific said that the main reason was that the company made asset impairment provisions in the same period last year. It operated normally and did not have a large amount of asset impairment provisions in the current period.

Compared with the improvement of the performance of small and medium-sized securities firms in the third quarter, the performance of the top securities firms was slightly weaker. Huachuang Securities believes that from the announced financial reports of listed securities firms, the industry’s net profit has declined significantly due to the downward impact of market sentiment. However, the long-term center of the return on assets of securities firms has not changed much, and under the supervision and guidance of the industry to continue to pursue a capital-intensive development model, the industry’s leverage has continued to increase rapidly, which means that the potential center of the industry’s ROE may have continued to increase.

Under the expectation of optimizing regulatory indicators and loosening capital constraints, we continue to be optimistic about the rapid recovery of ROE in the market sentiment of securities companies.

Big news just came

China Evergrande straight up

Shortly after the opening of the morning on the 30th, China Evergrande’s intraday share price plunged, falling by more than 20% at one point. Near midday, China Evergrande turned from a decline to a rise, and by midday it was up more than 5%.

Hong Kong’s High Court will today hear a petition filed by offshore investor Top Shine Global to wind up Evergrande, the largest property developer to be liquidated in Hong Kong’s legal history, according to reports.

Just now, China Evergrande announced that the High Court on October 30, 2023 further postponed the hearing of the petition to December 4, 2023.

According to international financial reports, the Hong Kong court has postponed Evergrande’s liquidation hearing several times, but Evergrande’s long road to restructuring has not yet seen a clear turnaround.

"This is really the last postponement," Linda Chan, a High Court judge, said on Monday.

She pointed out that if the company failed to meet the standards she had set, the court was "likely" to issue a winding-up order at the next hearing.

Creditors of Chinese real estate companies are closely watching Evergrande’s liquidation petition hearing. Whether Evergrande is finally able to workout or declare bankruptcy liquidation, it will provide a roadmap for other real estate companies.

Not long ago, Hengda said that it is revising the terms of the proposed workout, hearings related to the restructuring agreement have been cancelled or postponed, and Hengda board chairperson Xu Jiayin has also been taken coercive measures for suspected illegal crimes, which once caused financial marekt turmoil, which is consuming investors’ patience.

According to people familiar with the matter, Evergrande recently held talks with some creditors who opposed the restructuring plan, and the details of the talks were not yet known.

Evergrande said in April that there are two groups of creditors that have not given sufficient support to the overseas workout plan, of which C creditors are the larger group.

Hong Kong courts have issued at least three winding-up orders against Chinese developers since the 2021 debt crisis, despite jurisdictional issues between the Chinese mainland and the territory.

After a winding-up order is issued, the court can appoint a liquidator who will take control from the directors and management to make major business decisions and seek proceeds for creditors from existing assets.

Huawei’s big move

Multiple shares daily limit

Recently, due to the launch of Huawei’s Mate 60 series of mobile phones, "far ahead" has become a hot word on the Internet.

According to the Tianyancha App, Huawei Technologies Co., Ltd. recently applied for the registration of the "far ahead" trademark, which is internationally classified as transportation means and scientific instruments. The current trademark status is pending substantive examination.

On the afternoon of September 12, Yu Chengdong, executive director of Huawei, CEO of end point BG, and CEO of smart car solutions BU, appeared at No. 31 Qiantan, Shanghai, to preside over the launch of the new M7 on the same day. Although it has been reported that the release does not include new product information such as mobile phones, various terms related to the launch have been on the hot search list of social platforms one after another on the day. Interestingly, Huawei’s new product launch was "far ahead".

According to statistics, during the 90-minute release session, Yu Chengdong mentioned "far ahead" at least five times and "leading" more than 20 times on the spot, and each time he mentioned it, it aroused applause from the audience.

Since September, Huawei Mate 60 series started "Pioneer Program", Huawei Mate 60 series mobile phone loved by consumers, is still "a machine hard to find", in addition, according to the CINNO data report, in the ultra-high-end folding screen market, Huawei accounted for 50% of the market share; car business, ask the new M7 after the official listing, sales continued to rise, the average daily order volume of more than 1,500 units, less than two weeks on the market, orders have exceeded 20,000 units, according to the latest data, ask the new M7 cumulative set has exceeded 60,000 units.

The technological revolution brought by Huawei has triggered a new round of consumption. The consumer electronics sector continues to strengthen.

Zhuosheng Micro, Jingyan Technology 20CM daily limit, Visionox, Guoguang Electric Appliances and other stocks daily limit.

copyright notice

"China Foundation News" has the copyright to the original content published on this platform and is prohibited from reprinting without authorization, otherwise it will be investigated for legal responsibility.

Authorized reprint Cooperation contact: Mr. Yu (Tel: 0755-82468670)

Original title: "Just now, Evergrande exploded"

Read the original text