Image source @ vision china

A brief introduction to Chinese businessmen

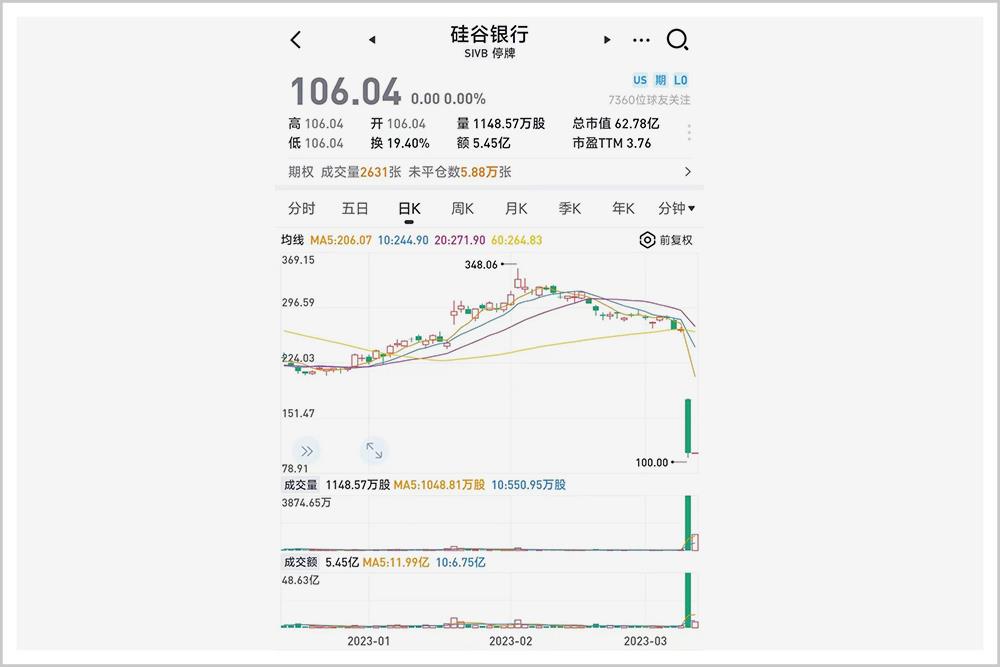

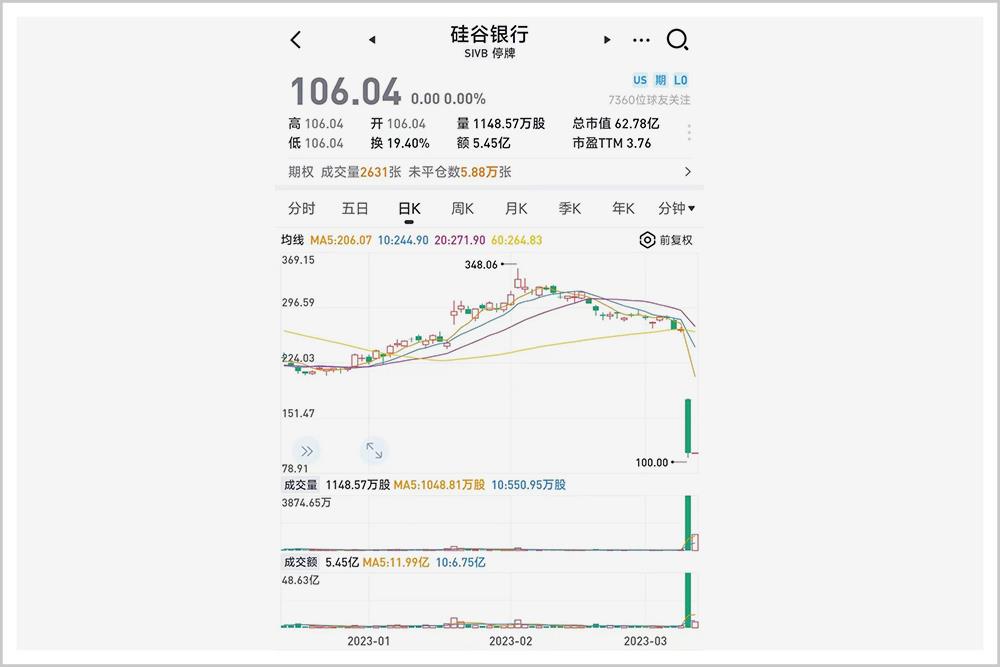

On March 11, 2023, the Silicon Valley Bank of the United States, which managed $175.4 billion in deposits, collapsed.

Founded in 1983, it is the 16th largest bank in the United States and one of the largest banks in Silicon Valley. By the end of 2022, the total assets under management of Silicon Valley banks reached 212 billion US dollars.

This is the biggest bankruptcy case of American financial industry since the subprime mortgage crisis in 2008.

01 trillion banks, can’t hold on.

On March 9, Silicon Valley Bank released a bad news:

The bank lost $1.8 billion because it sold $21 billion of securities in its portfolio. In order to avoid the liquidity crisis, the bank decided to sell common shares and preferred shares to raise $2.25 billion.

This bad news caused the share price of Silicon Valley Bank to plummet by more than 60% in a single day, and its market value evaporated by 9.4 billion US dollars.

On March 11th, even worse news came. The California Department of Financial Protection and Innovation announced the closure of Silicon Valley Bank, and the Federal Deposit Insurance Corporation was appointed as bankruptcy administrator to take over Silicon Valley Bank.

On March 11th, even worse news came. The California Department of Financial Protection and Innovation announced the closure of Silicon Valley Bank, and the Federal Deposit Insurance Corporation was appointed as bankruptcy administrator to take over Silicon Valley Bank.

Although the Federal Deposit Insurance Corporation provides standard insurance of up to $250,000 for each depositor, it is not clear how much this will help the big customers of Silicon Valley Bank.

Silicon Valley Bank is very special. Most of its customers are technology startups and investment institutions, and it is a "to B" bank.

Since its establishment, the reputation of Silicon Valley Bank has been very good. So far, Silicon Valley Bank has supported more than 30,000 startups and more than 700 investment institutions, including facebook and Twitter. In the credit market of start-ups, it accounts for more than 50%.

The business of Silicon Valley Bank is not limited to the United States. It has branches in China, Indian, Israeli, British, German … almost the most important entrepreneurial market in the world.

In 2012, Shanghai Pudong Silicon Valley Bank was established. With the title of the first Sino-US joint venture bank in China, it has served more than 2,000 local science and technology enterprises in China. From artificial intelligence and big data to enterprise services, medical and health care, industrial internet and new consumption, all the hot spots are not absent.

Why did such a seemingly powerful and reputable bank collapse suddenly?

The answer is related to a key word:Federal reserve.

During the COVID-19 epidemic, in order to stimulate the economy, the US Treasury and the Federal Reserve passed a crazy rescue plan in 2020, injecting about 5 trillion US dollars into the financial market. In March of that year, the Federal Reserve cut interest rates by 150 points and kept the federal basic interest rate near zero. In 2021, Biden’s government continued to increase the code and approved the US rescue plan of 1.9 trillion US dollars again.

A large amount of water injection and the loose policy of zero interest rate have caused a surge in financial transactions and "stimulated" Wall Street into a prosperous period.

The Bank of Silicon Valley is also the beneficiary of this round of prosperity. In 2021, the amount of deposits in the technology stock bull market created by the liquidity of the Federal Reserve surged. At the end of 2019, the deposits of Silicon Valley banks were only about 60 billion US dollars, and in 2021, it reached the order of 190 billion US dollars.

After eating a lot of deposits, banks want to make money. The general way is to borrow money from commercial institutions and put the money out to eat interest.

The deposits of Silicon Valley banks originally belonged to these startups. Moreover, in recent years, the growth of technology and consumer industries has slowed down, and the financing needs of startups are declining, and loans cannot be released at all.

So, there is only one way for Silicon Valley Bank:Use customer deposits to invest directly.

In terms of investment direction, the choice of Silicon Valley banks is still relatively cautious. It allocates more than half of its assets to mortgage-backed securities.

The return on this investment direction is not high, and it is between 1.5% and 2% in yield to maturity. But the advantage is stability, not to mention that the cost of deposits used by Silicon Valley banks for investment is generally around 0.25%, which is still a steady profit.

However, the policy hand of the Federal Reserve changed this situation. The Federal Reserve, which had injected water crazily before, then began to raise interest rates crazily.

Since March 2022, the Federal Reserve has raised interest rates seven times in 2022, with a cumulative increase of 425 basis points. Eventually, the Fed will raise the target range of the federal funds rate to 4.25%-4.50%, reaching the highest level since the subprime mortgage crisis in 2008.

After entering the interest rate hike cycle, the investment assets held by Silicon Valley banks suffered a blow.

A very simple logic is:Even the federal funds have an interest rate of 4.5%. Who will hold mortgage-backed securities with a yield of only 1.5%?

As a result, the price of mortgage-backed securities began to plummet. At the same time, due to the change of financing environment, startups began to consume deposits continuously, and Silicon Valley banks were forced to sell assets to cope with liquidity, which led to a large number of floating losses in Silicon Valley banks and had to sell investment securities at a loss.

Until March 9, the Silicon Valley Bank, which really couldn’t survive, finally stood up and announced the fact that it had cut its own meat and suffered a sudden loss.

As soon as this news came out, it triggered a panic in the market, and everyone inevitably thought that there would be a big problem in the liquidity of Silicon Valley banks.

The collapse of the whole system of Silicon Valley banks inevitably happened.

02 Wall Street, chilly.

Under the Federal Reserve’s interest rate policy of "first drop and then increase", Silicon Valley Bank is not the only financial institution that has experienced ups and downs.

During the boom of Wall Street, the Wall Street financial giant Goldman Sachs Group also benefited greatly.

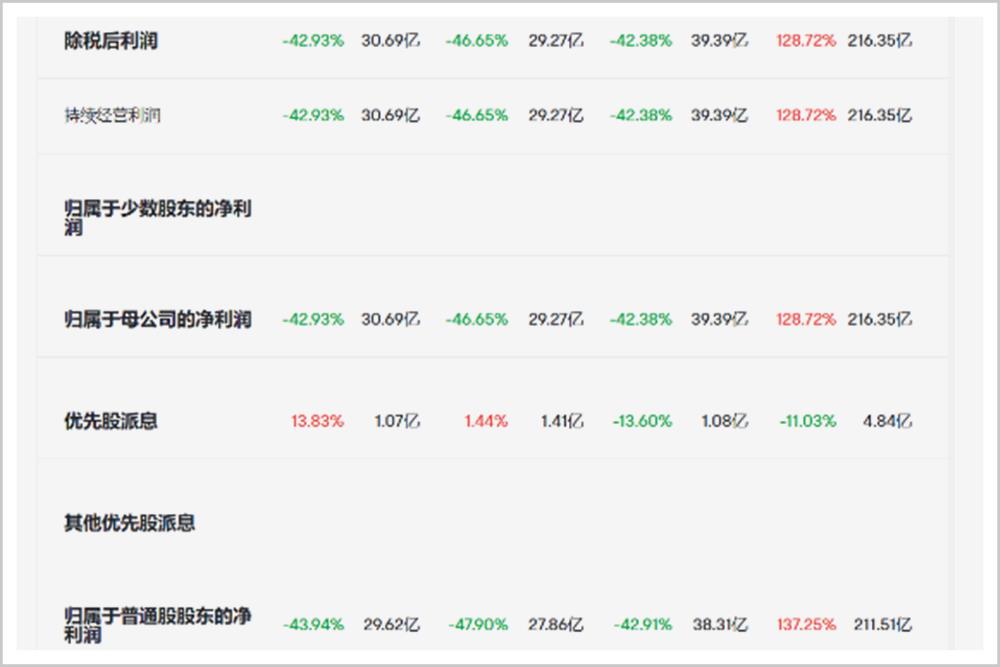

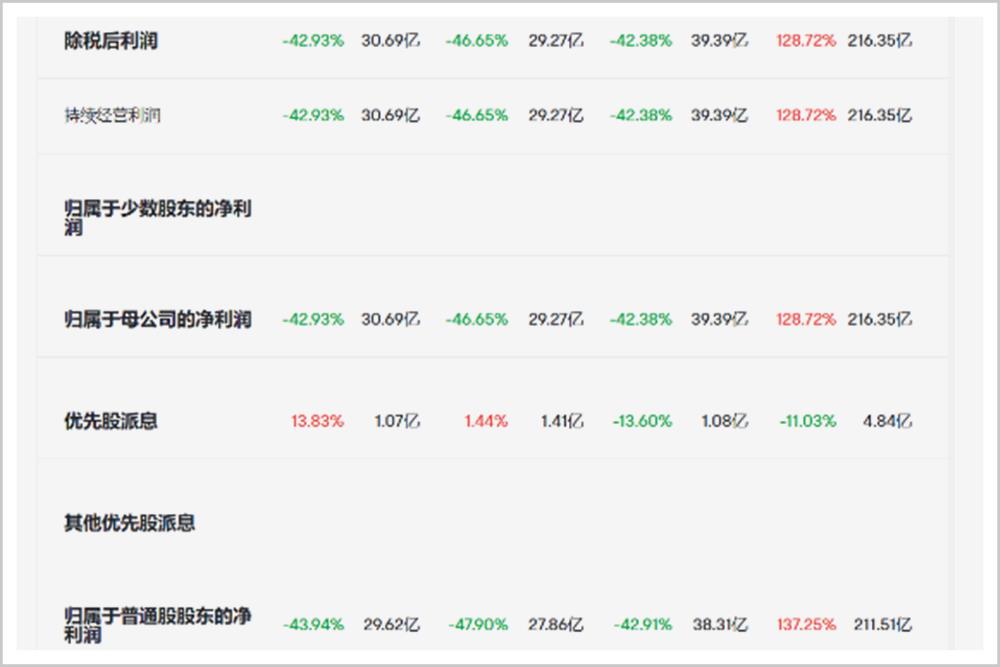

Its net income reached $59.3 billion and net profit reached $21.6 billion in fiscal year 2021, an increase of 137.25% year-on-year, setting a record high.The annual transaction income of the five largest investment banks in the United States, such as JPMorgan Chase and Citigroup, reached $100 billion for the first time in more than a decade.

In order to cope with the increasing business volume, Goldman Sachs set off a recruitment boom. By the third quarter of 2022, Goldman Sachs had 49,100 employees, a surge of 34% compared with 2018.

The number of employees in all walks of life has also greatly expanded. From the first quarter of 2020 to the third quarter of 2022, the number of employees at Morgan Stanley surged by 34%. The number of employees in JPMorgan Chase and Citigroup increased by 13% and 17% respectively.

But the good times won’t last forever. The interest rate policy of the Federal Reserve, after pushing the financial market to the top of the mountain, made it fall down severely.

In 2020-2021, under the bottomless water injection of fiscal and monetary policies, the American stock market was super prosperous and hit a new high. At the end of last year, the US Dow Jones index rose nearly 19%, the Nasdaq index rose 21%, and the S&P 500 index rose 27%.

By September 2021, their P/E ratios had risen to 25.9 times, 39.9 times and 26.6 times before the epidemic respectively, while their P/B ratios had increased by 6.73 times, 5.9 times and 4.51 times.

However, the interest rate hike in March, 2022 made the valuation of US stocks extremely cold. Since 2022, the benchmark S&P 500 index has fallen by 19.8%, or it will be the biggest annual decline since 2008. It’s like riding a "crazy roller coaster", described by Federal Reserve Chairman Powell.

The decline in the stock market has also slowed down IPO financing sharply, which has greatly reduced the business volume of Goldman Sachs. The number of transactions decreased by 73%, while the transaction amount decreased by 95%. Goldman Sachs’ financial report in the second quarter of 2022 showed that its net profit fell by nearly 48% due to the 41% decrease in investment banking income.

All kinds of unfavorable factors swept through, which made the net profit of Goldman Sachs increase between -40% and -50% in the first three quarters of 2022. At the end of October last year, judging from the results announced by the giants, JPMorgan Chase’s net profit fell by 17% year-on-year, and Bank of America’s net profit fell by 8% year-on-year.

This is really an ominous sign:The prosperity achieved by the Fed’s massive water injection a few years ago is coming to an end, and everyone should prepare for a hard life.

This is really an ominous sign:The prosperity achieved by the Fed’s massive water injection a few years ago is coming to an end, and everyone should prepare for a hard life.

"Our future life will be very bumpy, and we must be more cautious in financial resources, especially in the short term",In 2022, David Solomon, CEO of Goldman Sachs, publicly stated many times that he hoped to control expenditure in the future.

The initial warning came from July. When Solomon saw the bleak second-quarter earnings report and judged that the US financial market would remain depressed for a long time to come, he immediately took precautions and told everyone in advance that Goldman Sachs would probably slow down recruitment and cut expenses in the future.

In September, Goldman Sachs first resumed its annual performance evaluation, which was suspended for two years during the epidemic. At that time, 500 people were laid off, and those who kept their jobs later found that their year-end bonuses were much lower than expected.

Regarding the future trend of Goldman Sachs, CEO David Solomon’s statement in an interview is:This will depend on the next Fed trend and inflation trend.

With the overall income of Wall Street investment banking business shrinking by about 40%, the largest banks have said that they will continue to lay off employees, and the whole industry is at the forefront of layoffs and optimization.

"Some people will be fired. We are laying off employees moderately around the world. For most enterprises, this is the situation after many years of development. "Following Goldman Sachs, james gorman, CEO of Morgan Stanley, also announced the layoff plan to the media.

Morgan Stanley has nearly 82,000 employees, and this time it announced about 1,600 layoffs, accounting for 2% of its total employees. In November 2022, the financial report data released by Morgan Stanley showed that its profit in the third quarter of fiscal year fell by 29% and its revenue fell by 12%.

Under such circumstances, JPMorgan Chase, Bank of America, Citigroup and other financial institutions are also considering cutting bonuses by one third or more. The incentive pay of wall street investment banks may drop by more than 45% as a whole.

Closely accompanied by the coldness of investment banks, there are deep worries about the prosperity and decline of the US stock market and anxiety about the Fed’s continued interest rate hike.What’s more, Wall Street generally has no hope for next year’s US economic forecast.

"The US stock market will usher in the worst year since the global financial crisis, and corporate profits will also suffer the same fate",Mike Wilson, chief US stock strategist at Morgan Stanley, warned the outside world.

The uncertain prospects of global economic growth make investors hesitate to invest for a long time. "We must assume that we will have some rough times in the future," David Solomon told the media. "We must be more cautious about financial resources and organizational scale.

On November 30, 2022, Powell once again publicly stated to the public that the fight against inflation in the United States is "far from over" and the Fed’s interest rate hike means "will continue for some time". He believes that,"In order to control inflation, we can even sacrifice certain employment and economy."

Continued aggressive interest rate hikes have made the market’s expectations of the US economic recession increase day by day. However, Biden said that the current economic slowdown is "not surprising" and he insisted that "the United States is still on the right path". And insist that even if there is a recession in the American economy in the future, it will be a very "slight" recession.

Wilson was very worried about the recent signs of weakness in the American economy under the warning of a recession. Perhaps the only good news is that Wilson assured the public that "fortunately, there are no signs of systemic financial risks or difficulties in the real estate market".

However, some business people represented by Musk are not so optimistic about the future.

Elon musk, CEO of Tesla, has warned people on many occasions that the US economy may face a serious recession lasting for one to two years. On November 30th, he wrote on Twitter again,"The Federal Reserve is continuously amplifying the possibility of a serious economic recession, and the US economic trend is worrying".

Jeff Bezos, the founder of Amazon, bluntly said in front of the media that the economic recession in the United States is close at hand. He even suggested that the American people should cut down their expenses as much as possible in the next few months and not buy big items such as cars and televisions.

The pessimistic attitude of entrepreneurs comes from their sober observation of themselves and their peers.

Just in January 2023,IBM announced that it will lay off 3,900 employees and reduce the number of its 280,000 employees by 1.4% in order to divest its medical and health business.

In 2022, the major technology giants in the United States have laid off more than 60,000 people. Many people think that this is the end, but they don’t know that this is just the beginning.

As soon as it entered 2023, Amazon confirmed the start of a new round of layoffs, and the number of layoffs is expected to reach 18,000, making it the largest layoffs in Amazon history;

Microsoft announced that it will lay off 10,000 employees at the end of March, and Google will lay off 12,000 people. Twitter’s goal is to reduce the total number of employees to the pre-IPO level.

Dr. Rouriel Roubini, who accurately predicted the financial tsunami in 2008, is even more pessimistic. He believes that the US economy will not only face inflation and fall into recession, but also usher in a "stagflation debt crisis".

"High inflation will bring higher interest rates, slow growth and weak labor market conditions, and it will also bring pain to families and enterprises," Powell explained to the public.

"We must control inflation. I hope there is a painless way to do this. But it didn’t. "

03 real estate, hidden worries reappear

As a core fixed asset, American real estate is actually in a delicate or even bad situation.

During the epidemic, the Federal Reserve continued to inject water for two years, which led to the financial prosperity and even the bubble on Wall Street, and also made American real estate once again reach a dangerous height and face risks.

In 2020-2021, the American property market experienced a boom that had never happened in the past two decades.

The term "How much will American housing prices rise in 2021" has increased by 350% in Google’s search frequency within one week.

"The price is almost heaven." A property buyer said excitedly, "Basically, it depends on grabbing. It is common for dozens of people to grab a suite. It is impossible to buy a house without increasing the price."

In April 2021, Mr. Zhang, a Chinese resident living in San Diego, California, told the media that a good house in the neighborhood of his home could be sold in about 10 to 15 days after it was hung up. In order to impress the original owner, the buyer must increase the price by at least 10%-20%.

"Every day, there are about thirty or forty groups of people waiting in line to see a suite. Many people come directly with cash, and sometimes they are directly robbed by the people in front before they get to themselves."

In 2021, 6.12 million properties were sold in the United States, reaching the highest performance since 2006. During the post-2020 epidemic, house prices in the United States rose by 43% in two years. At the same time, the data shows that house prices in 20 cities in the United States soared by 14.9%, the highest level since November 2005.

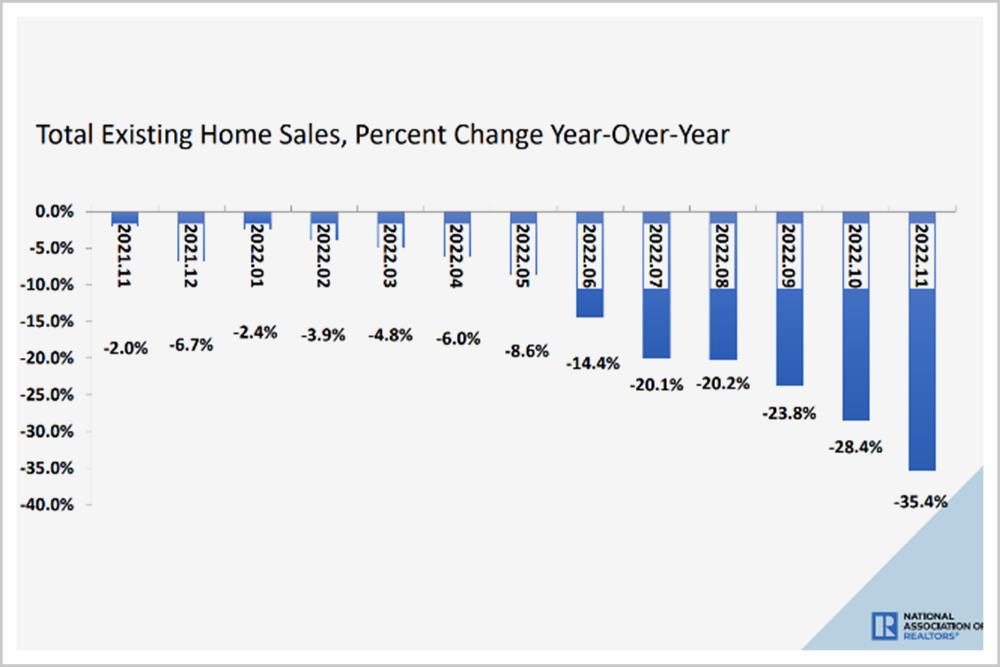

In the first half of 2022, the hot trend of the US property market continued. In February, house prices rose by 19.8% year-on-year, the highest increase in 25 years and four times the average increase in the past decade. In June, the median selling price of American houses reached the top, reaching $413,800.

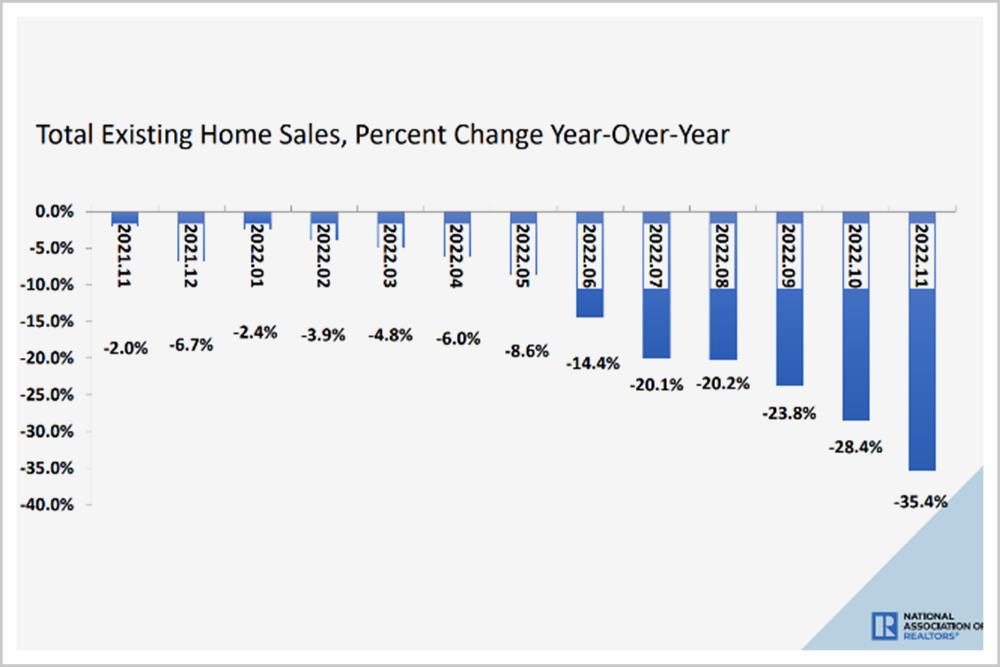

Then, the violent interest rate hike by the Federal Reserve pushed the US property market to a cliff.

At the end of October, the mortgage interest rate in the United States exceeded 7%, the highest level in 20 years.

With the surge in interest rates, the confidence index of American home buyers quickly fell to 39, the lowest level since the 1980s. In December, the confidence index of NAHB home builders in the United States was only 31, lower than that in February 2007. An index below 50 indicates that the real estate market is in a contraction period.

Both buyers and sellers lack confidence, so that the originally fiery property market quickly entered the freezing period. At the same time, mclaughlin, chief economist of Kukun Company, boldly predicted that the good days when working families could easily buy high-quality housing anywhere in the United States were over. The soaring housing prices in the past two years may force them to extend the time for buying houses by five to ten years.

The rising interest rate has greatly increased the repayment pressure of buyers; The continued high housing prices have hit the purchasing power of buyers. In the end, the demand for house purchase dropped sharply, and house prices changed from rising to falling.

In 2022, the total sales of finished houses decreased for 11 consecutive months, and house prices could not keep increasing in the second half of the year and began to fall back. Diane Swonk, chief economist of KPMG, predicts that house prices in the United States may fall by 15% in 2023.

The sudden slowdown of the once-soaring real estate market has made the value of stocks firmly bound to real estate extremely uncertain. Nouriel roubini believes that the stock value will shrink by as much as 40% in 2023.

The sudden slowdown of the once-soaring real estate market has made the value of stocks firmly bound to real estate extremely uncertain. Nouriel roubini believes that the stock value will shrink by as much as 40% in 2023.

After experiencing the soaring housing prices in the United States during the two years of the epidemic, many people began to wonder whether the real estate bubble in the United States has piled up again. After all, one of the keys to the financial tsunami in 2008 was the real estate bubble. Now the United States is facing the double pressure of real estate and stock market, which makes people worry that a bigger storm is brewing.

Many people have forgotten that in 2002, former Federal Reserve Chairman Alan Greenspan said,"The prosperity of our real estate market is actually composed of a large increase in mortgage debt, which is unsustainable".

On the eve of the financial tsunami, American house prices rose by 10% every year, by 17% in 2005, and by more than 50% in the four years from 2003 to 2006.

In the five years from 2002 to 2006, the Federal Reserve raised interest rates 17 times in a row. As a result, the interest rate of housing loans has soared, and house prices have collapsed and fallen wildly.

The collapse of the property market brought down the stock market and plunged by 50%. Then the unemployment rate increased greatly, and household consumption and business investment decreased rapidly. Finally, the American economy fell into recession. Then it triggered a financial tsunami that affected the whole world.

Although Federal Reserve Chairman Powell is optimistic, he believes that the current American real estate is very stable, and there will be no recurrence of the 2008 crash and no economic recession. The mainstream view of the market also believes that the rapid rise of the US housing market during the epidemic period is not the same as that in 2008.

However, nowadays, large banks have closed down, technology and finance enterprises have laid off a large number of employees, the stock market has flourished and declined, and the hidden troubles in the housing market have reappeared. More and more people feel that this story is deja vu.

While they are worried, they keep speculating in their hearts: Under the operation of the Federal Reserve, will the collapse of the Silicon Valley Bank be just the beginning? Will the United States set off another financial and economic catastrophe?