Beauty cosmetics may be the first industry to "roll up".

In the general environment, the growth rate of cosmetics retail market has slowed down, and various new regulations of the industry have gradually landed, and the business pressure of enterprises has suddenly increased; On the channel side, online traffic dividends are disappearing, and offline channels are still lingering in winter; On the brand side, new domestic products began to get cold, and international beauty brands also felt the chill.

According to incomplete statistics, in 2021, more than ten international beauty brands will either withdraw their cabinets, clear their warehouses or even stop operating in China. In the counted cases, the groups of imported brands are mainly international beauty giants, such as Yueshi Fengyin, owned by Korean Amore Pacific Construction Group, Benefit Bellingfield, a makeup brand owned by LVMH Group, and Jurlique, an Australian skin care brand, etc., involving skin care, makeup and care.

If there is a brand withdrawal, there will be a brand rise. When overseas beauty care brands want to test the water market in China, how can these brands make a breakthrough from 0 to 1? What channels should policymakers consider? How do they diagnose the shortcomings of brand development and make rapid adjustments?

In view of these problems, today’s case focuses on three beauty care brands, Fulifang Silk, Whoo Hou and Fulu Deya, which have maintained rapid growth in recent five years from the perspective of e-commerce operation, in an effort to put forward more prospects and thoughts for the further development of overseas beauty care brands in China market.

Author | Yang Li Yan Min

Source | cheung kong graduate school of business Case Center

In recent years, the scale of online transactions in China’s beauty industry has risen rapidly, and the growth rate far exceeds that of offline channels.E-commerce platforms represented by Tmall, JD.COM and Xiaohongshu have become the main distribution channels of overseas beauty care brands in China market.

This report focuses on three beauty care brands from the perspective of e-commerce operation: Fu Li Fang Si, Whoo Hou, Fu Lv De Ya.

All three brands are overseas brands that have entered China in recent years. They chose Tmall platform as one of the main channels for them to expand the China market, and commissioned local e-commerce to operate the company Liren Lizhuang service brand. All three brands have achieved sustained and rapid growth for more than five years.

Among them, Fulifang Silk comes from Japan and mainly sells amino acid formula cleansing products. In 2015, it entered Tmall, with annual sales of nearly 1 billion in 2021. The brand’s market share in Tmall cleansing products has exceeded 10%.

After Whoo, it mainly focused on facial care suits. In 2014, it entered Tmall, and in 2021, the store sales reached 2.56 billion. It is the largest and fastest growing Korean beauty brand in Amoy.

Fulv Deya is the first brand of scalp care in France. In 2015, the sales of Tmall flagship store was 3 million, and then it grew at a rate of over 100% for six consecutive years. In 2021, the sales exceeded 200 million.

Although the above three overseas beauty care brands have proven best-selling products in their local markets, they also have good brand power. However, in the face of the unfamiliar and opportunity-filled China market, how did these overseas beauty care brands achieve a breakthrough from 0 to 1?

In the ever-changing e-commerce market, how can they diagnose the shortcomings of brand development from massive data and make rapid adjustments?

Facing the future, can the above three brands achieve long-term sustainable growth through refined operation in the e-commerce market?

"Small pieces break big categories" is what many consumer brands want to do most:

Select a new track in the market, get stronger and stronger in this new track, and then surpass the development speed of big categories and become the leader of the whole big track.

Coca-Cola is like this to the soft drink market.

Fu Li Fang si asAmino acid formula cleansing productThe representative brand has basically realized the process of breaking the "big category" of cleansing products from the "small category" of gentle cleansing.

This achievement is due to two factors:First, it conforms to and cultivates the market background trend of mild skin care and amino acid skin care.

According to the statistics of Hidden Horse, in the TOP100 SKU of facial cleansing in double 11 from 2018 to 2020, the proportion of products with amino acid facial cleansing as the main selling point has increased from less than 50% in double 11 in 2018 to nearly 70% in double 11 in 2020.

The second is the operation team.(including brands and service providers)I have a deep insight into the operational logic of beauty care e-commerce and made fruitful operational actions.

Fulifang silk brand byKanebo JapanThe group was launched in 2001 and entered the China market with the concept of "cosmeceuticals" in 2005. Because there is no drug store format in China, Fu Lifangsi initially chose Watsons and other channels to expand the offline market.

In 2014, the sales of Fulifang Silk Network was about 33 million. At the same time, Liren Lizhuang, an e-commerce operation service company, judged that Fulifang silk has a huge room for improvement because:

One,Tmall digital intelligence tools show that the number of times consumers search for "amino acid cleansing" is on the rise, behind which is the rise of "component party"-this group of users do not blindly believe in "big names", but pay more attention to the real efficacy of products;

Second, since 2014, the rise of Tmall cosmetics indicates that the makeup market in China will usher in explosive growth, and the increase in the use of cosmetics will immediately bring more moderate demand for facial cleansing.

As a result, Fulifang Silk Tmall flagship store chose a new one in 2015.E-commerce operation service provider. From brand positioning to store management, refined and digital e-commerce operation has gradually brought Fulifang silk from niche brands to category number one.

The first is to reposition the brand.

Based on the insight into the trend of "amino acid cleansing", the operation team no longer uses the concept of "cosmeceutical" to define Fulifang silk, but equates it with the concepts of product selling points such as "amino acid cleansing" and "sensitive muscle friendliness".

Zhihu is a KOL for skin care.(opinion leader)One of the active platforms focuses on a large number of skin care products "component party" and "efficacy party" groups. The early core customers of Fridays came from the recommendation of KOL.

From a large number of questions and answers from Zhihu to WeChat WeChat official account, Xiaohongshu, Tik Tok, Aauto Quicker, etc., Fulifang Silk has gradually been endowed with the brand image of "the originator of amino acid cleansing".

In Tmall Station, the concept of "amino acid cleansing" has been repeatedly emphasized in every graphic propaganda and advertising of Fulifang Silk.

In the specific marketing activities, it is the daily work of the operation team to finely deliver according to the crowd portraits provided by the e-commerce platform and make good use of every marketing expense.

The second is to adjust the sales strategy.

In 2016, as a classic formula product of Fulifang Silk "Amino Acid Cleansing", "Fulifang Silk Cleansing Cream" quickly rose to the top three in Tmall Cleansing category, and then firmly occupied the top position.

Fridays used to sell 580 yuan/sets of water emulsion suits, and the higher unit price of the suits meant stronger competitors.

The operator quickly adjusted the store strategy, and mainly promoted 150 yuan/Branch’s 100g "Fulifang Silk Cleansing Cream", which on the one hand strengthened the brand features and product selling points of "Amino Acid Cleansing", on the other hand effectively lowered the consumption threshold, and achieved the explosion of "double 11 Cleansing Category NO.1 for five consecutive years".

Explosives can get the qualification to participate in Tmall’s large-scale marketing activities, which is equivalent to getting a lot of free traffic, making a benign interaction between stores and platforms.

After that, the acting operation team, after consultation with the brand, further introduced the 60g small-sized "Fulifang Silk Cleansing Cream" from 99 yuan/Branch.

Due to the high cost of small-sized products, the brand initially hesitated. However, in June 18, 2021, through the large-scale preferential activities of buy one get one free, combined with the cooperation of the head anchor, the 60-gram small-sized facial cleanser sold more than 1 million pieces, effectively attracting more new users to contact Fulifang silk.

Because of the refined operation, the flagship store of Fulifang Silk Tmall started with sales of more than 60 million yuan in 2016, and almost doubled year after year, with sales reaching 854 million by 2020.

In 2021, the sales of Fulifang Silk Tmall flagship store reached 969 million, with an increase rate of 13.5%.It is higher than the overall growth level of the industry of beauty and skin care products by 11%.

It is worth noting that in the case that the traffic cost of the e-commerce industry is generally rising, Fu Lifang has been in the past three years.In-station marketing cost(Note: In-station marketing cost = In-station marketing expenses /GMV)However, it remained stable and there was no upward trend.

Even if it is done in 2021.Chaotou(Note: Super head is the super head anchor, such as Li Jiaqi, etc.)The lowest discount rate of the over-head is only 90% of the conventional minimum discount rate, which has little impact on the unit price of the product.

In the last two years, traditional big-name brands and cutting-edge brands have launched similar products to compete for the amino acid cleansing market, and Fulifang silk is facing more intense brand competition.

The market share of Frestex in cleansing products has exceeded 10%, reaching the beauty market.A single brand is at a higher level of a single category.Competitors use price war methods such as the same price and quantity, the same quantity and low price, and constantly introduce a variety of products.

The product research and development team of Fulifang Silk is far away from Japan. Influenced by the relatively conservative Japanese business culture, it believes in the mature and classic amino acid cleansing formula, and the motivation to upgrade the formula is weak.

Similar to other international brands, the Japanese R&D team may not respond quickly to the needs of the China market, although Fridays China Company attaches great importance to the market insight gained by the generation operation team from data operation.

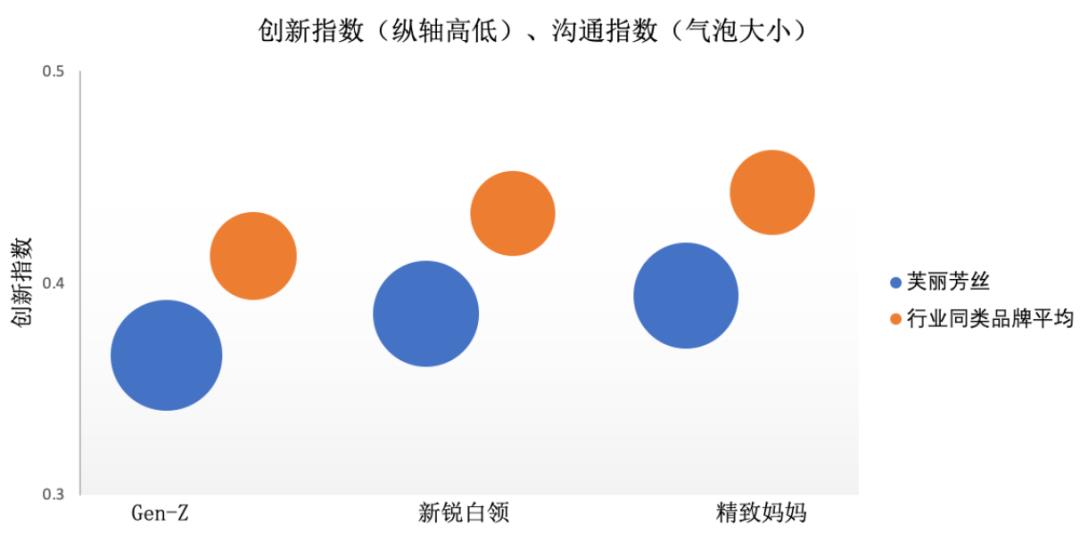

Figure 1: Diagnosis of the brand mental index (NEO) of Tmall brand of Fulifang Silk.

E-commerce digital intelligence tools can help us to further pay attention to and discuss the brand innovation of Fulifang Silk.

On the basis of systematically combing the classic business theories and business models of consulting companies, Tmall platform puts forward brand crowd mental index (NEO) from three dimensions of innovation, Engagement and sOlidiy, and combines it with brand crowd asset index (FAST) to form Tmall brand power model.

Among them, the innovation index includes two indicators: pioneer concentration and brand selling point relevance; the communication index includes three indicators: brand search popularity, close fans/active members concentration and brand recommendation concentration; and the value index includes three indicators: premium rate, positive price rate and repurchase rate.

As shown in fig. 1, according to this diagnostic tool, during the observation period,(June to December 2021)Inside and outside, the brand communication index of Fridays is better than that of the three strategic groups.Similar brands in the industry(Note: "Similar brand in the industry" is defined by the operation team through the long-term tracking of Tmall’s sales of digital intelligence tools. The dimensions to be considered include brand positioning, product positioning, price segment, portrait of users, inflow and outflow of brand people, etc.)And the "brand selling point relevance" in the innovation index still has room for further improvement.

NEO diagnostic tools can help brands to abandon subjective assumptions and urge them to think about the next marketing optimization measures.

As the leader of amino acid cleansing logic, how can Fulifang silk continue its brand influence on the concept of amino acid skin care and gentle cleansing? In the face of many competitors, can the classic formula alone continue to lead the gentle cleansing market?

Whoo is a high-end beauty brand launched by South Korea’s LG Life and Health Group in 2003. The post-Whoo brand is called "The History Of Whoo post-Whoo", which means the secret of the queen. The product is famous for its "unique skin care formula of the court". The skin care ingredients are extracted from precious medicinal materials such as ginseng and velvet antler, and the product packaging design also reflects the noble and elegant oriental style.

In South Korea, after Whoo, Li Yingai, a star, was hired as the brand spokesperson, which was deeply loved by high-spending people, and it was also a gift brand for the foreign affairs visit of the President of South Korea.

After entering the China market in 2006, Whoo mainly relied on the sales channels of shopping malls.

In 2014, Whoo settled in Tmall, and in 2016, it achieved annual sales of 155 million.

Due to the caution of Korean brands in China market and the invisible "Korean Restriction Order" since 2016, Whoo has never launched a large-scale advertisement in China market.

As a high-end beauty brand, Whoo will be associated with the mystery of Estee Lauder, Lancome and Hailan.(La Mer)It can be imagined that it is difficult for European and American brands to win the high-end beauty market.

How to achieve rapid growth after Whoo? In 2016, Liren Lizhuang took over the operation of the Whoo acquired cat flagship store and established the main operation idea: due to the shortcomings of weak public domain communication after Whoo, the auxiliary brands will achieve geometric growth in the next few years.First of all, we must have a deep consumer base and communicate directly with users through various means.

In the specific operation, the generation operation team divides consumers into two groups: "new customers" and "old customers".

How to develop "new customers"? The generation operation team uses the crowd labeling tool provided by the e-commerce platform to advertise and push the product selling point to the strategic crowd.

With the upgrade of platform marketing tools, operators can define multiple tags to find the target population.

For example, in the search for "facial care package" traffic, accurately identify people with high consumption power.

Considering the increasing cost of online marketing, the operation team attaches great importance to the maintenance of "old customers" and gives them more discounts and brand benefits to realize the effective activation of "old customers".

In recent years, withPrivate domain operation(Note: In the era of mobile internet, merchants can reach consumers directly through various communication tools, forming "private domain traffic", and this kind of interaction with consumers is "private domain operation")Becoming mainstream, the platform provides more tools to interact with consumers.

Private domain operation channels after Whoo include: Taobao group, store subscription, store live broadcast, shopping and so on. In double 11 in 2021, after Whoo, all private domain channels were fully linked and achieved good results:

In the live broadcast room of the store, the limited-time rights and interests (note: limited-time rights and interests generally refer to preferential prices or gifts that can only be enjoyed in the live broadcast room within a specific time range), the whole-hour formal attire, the delivery of iPhone13, and the invitation of stars and presidents to the live broadcast room led to a turnover of more than 200 million yuan, which attracted more than 128,000 fans’ attention and more than 65,000 new members.

The turnover of Taobao Group was 148 million, with more than 230,000 new people in the group, and more than 430,000 people entered the store.

From 2020, the generation operation team began to carry out more refined operations on private domain members. As of December 22, 2021, the total number of members reached 7.14 million, 14 times of the total number of members at the end of 2019.

Tianqidan water emulsion set is the main product after Whoo.In double 11 in 2021, more than 880,000 sets were sold, with sales exceeding 1.2 billion, accounting for nearly 90% of the total sales of the store in double 11, ranking first in the category of beauty, skin care and facial care sets for three consecutive years.

Based on e-commerce big data, operators predicted this trend as early as 2016. At that time, Tmall Digital Intelligence Tool showed that some consumers changed from searching for a certain beauty product to searching for skin care products.

Behind this behavior, two needs may be reflected:

First, consumers are no longer satisfied with simple skin care, but are eager to get more exquisite and systematic skin care methods;

Second, consumers hope to give more decent gifts to friends and elders through suits.

Based on the above judgment, the operator focuses on promoting Tianqidan water emulsion set to meet these needs.

Through a series of fine digital operations, the marketing cost of Whoo acquired cat flagship store in 2020 was the same as that in 2019, and even decreased by 10% in 2021, while the discount rate of goods remained unchanged.

At the same time, the flagship store of Whoo acquired cats maintained rapid growth year after year from 2016 to 2021, with sales of 870 million in 2019, explosive growth to 2.2 billion in 2020 and 2.56 billion yuan in 2021.

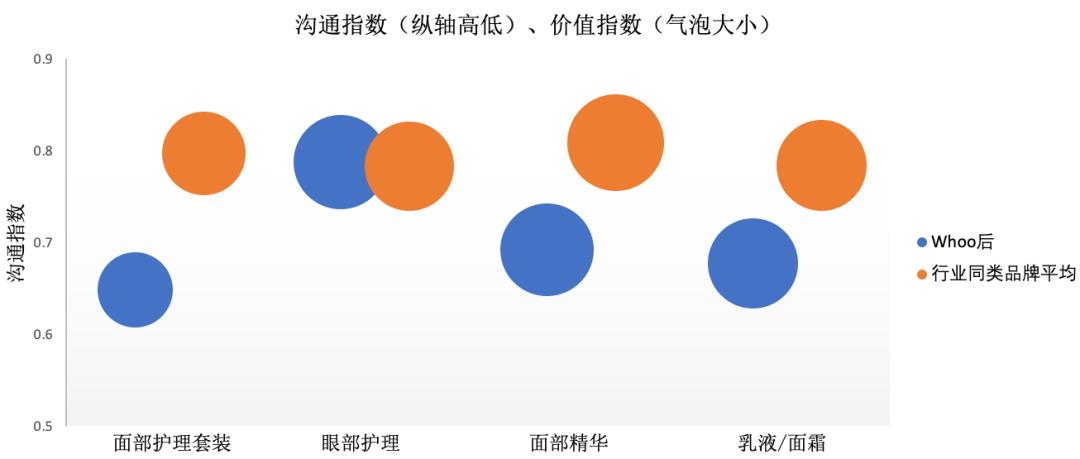

Figure 2: Diagnosis of Tmall Brand Mental Index (NEO) of 2:Whoo brand.

As shown in Figure 2, according to the Tmall brand mental index,(NEO)Analysis shows that the "premium rate" in the post-Whoo value index is at a high level among similar brands in the industry.

At the same time, during the observation period(June to December 2021)The communication index after Whoo shows an upward trend in many categories. This diagnosis result may be due to the intensive operation of the private sector population after Whoo during the observation period, which pushed up the communication index.

From the perspective of communication and promotion costs, the post-Whoo platform is greatly promoted.(Mainly 618, double 11)The communication cost during the period is lower than that of similar brands in the industry, so the communication index is low; During the promotion period in double 11, the marketing expenses after Whoo increased, which pushed the communication index to be equal to similar brands in the industry.

According to the NEO diagnostic tool, the brand communication index after Whoo has great potential for improvement. How can brands continue to grow under the circumstance of conservative advertising?

While paying attention to private domain operation, can we balance the high-priced image of the brand?(value index)Communicate with users(communication index)The relationship?

More importantly, should the long-term sustainable development of the post-Whoo brand in China continue to focus on the private domain, or should it need more public-private domain linkage and online-offline complementarity?

Fulv Deya brand was founded in 1957, and its star scalp care product "Three-phase Hair Nourishing Essence" ranked first in the sales of anti-shedding series in French pharmacies for 18 consecutive years.

Since entering the China market in 2015, Fu Lu Deya has regarded the e-commerce market as an important sales channel, which is due to several considerations:

1. Avene, a sensitive muscle brand owned by its parent company, Pierre Faber Group, has been successful in the e-commerce market in China;

Second, as a high-priced functional product, Fulu Deya is an efficient choice to reach the high-consumption anti-drop crowd by relying on the e-commerce platform and its big data tools.

Since 2015, Lulu Deya has settled in Tmall. In that year, the sales of flagship stores reached 3 million, and then it grew at a rate of over 100% for six consecutive years.

From 3 million in 2015 to 207 million in 2021, the flagship store of Fulu Deya Tmall entered the "100 million club" and achieved explosive growth. The market ranks from 50 to 8 in 2021, and ranks first in the categories of hair care essential oil bottles and scalp care.

It is particularly noteworthy that in the past three years, the ratio of in-station marketing expenses of Fulu Deya has shown a good trend of decreasing year by year, while the discount promotion of products has not increased. How does Fulv Deya brand stand out in the mixed anti-drop market?

The first is to define the product positioning.

In the market of hair care products in China, low-priced anti-shedding products emerge one after another, and their efficacy mostly stops at the "placebo effect", while Fulu Deya is different from these products.

First, Fu Lu Deya is positioned as "high-end anti-shedding and hair care", and the unit price of the goods is more than 235 yuan;

Second, Fu Lu Deya has a efficacy report issued by a professional laboratory, and dares to "shine a sword" in terms of efficacy.

On behalf of the operator Liren Lizhuang, it is suggested that the brand should cooperate with a third-party laboratory to make an investigation report, and extract the selling point of "3 months +7490 hairs" to directly hit the pain point of consumer demand.

As the main product to undertake this selling point, Fu Lu Deya’s "Three-phase Hair-nourishing Essence" accounted for 30% of the store sales growth, which realized the outbreak of single products that was essential for e-commerce.

The second is refined crowd operation.

Based on the confidence in the efficacy of the product, Fulu Deya chose Zhihu as the professional word of mouth, and Xiaohongshu as the vertical word of mouth to create a professional brand image through hospital channels. In the brand live broadcast room, many well-known bloggers and dermatologists from Huashan Hospital were invited to help out and establish a professional anti-detachment image.

In Taobao station, accurately screen people who have high consumption power and carry out multi-level and multi-angle marketing promotion.

Considering that there are 54 million people in Tmall’s anti-take-off crowd, at present, Fulu Deya has reached nearly 10 million people. It can be predicted that Fulu Deya brand will continue to be in a stage of rapid growth.

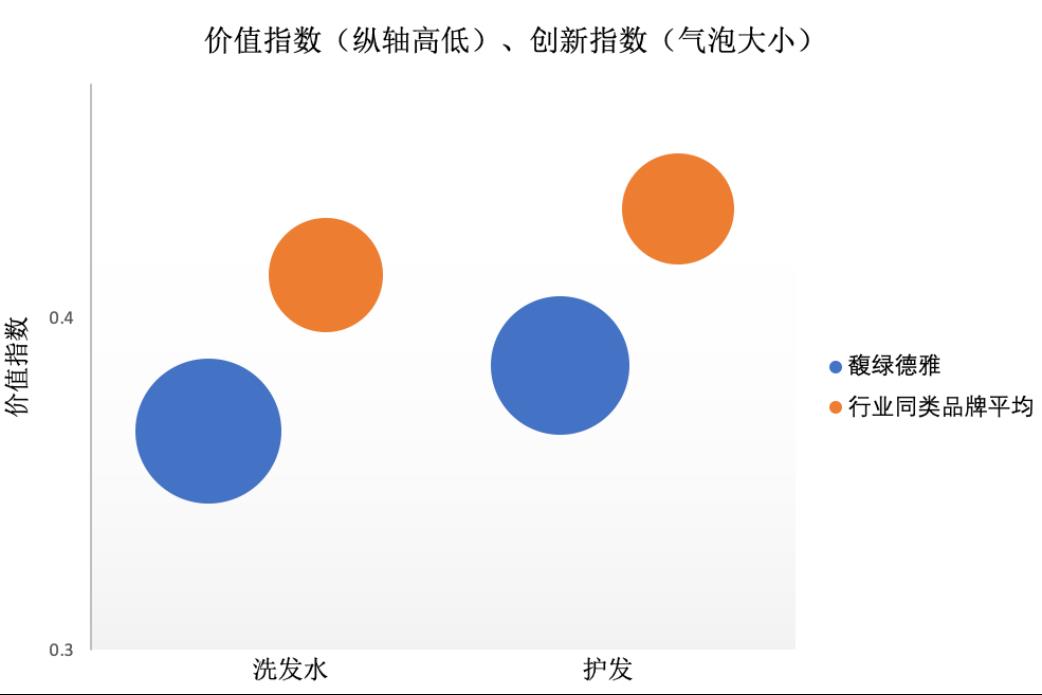

Figure 3: Diagnosis of Tmall brand mental index (NEO) of Fulu Deya brand.

According to Tmall brand mental index(NEO)Analysis, during the observation period(June-December 2021)Fu Lu Deya has a high innovation index and a high communication index, but the value index has room for improvement among similar brands in a series of industries.

Part of the reason is that, due to the different statistical caliber, there are differences in the statistics of product samples during the data observation period, which leads to the difference between the value index and brand awareness.

At the same time, the brand is worth thinking about how to continuously improve the traffic conversion rate while reducing the trial installation, so as to increase the overall premium of brand value and maintain the high-end image of the brand.

Fulifang silk broke the "big category" of cleansing products with gentle cleansing "small category" and became the first in the market share of cleansing products; After Whoo, the marketing expenses are much lower than those of similar brands in the industry, and the high-end beauty market is broken with strong private domain operation; Fulv Deya has achieved a high price break in the mixed anti-wash and hair care market, and it is in a stage of rapid growth.

The refined e-commerce operation of the above three overseas beauty care brands has brought several inspirations to the overall development of other overseas beauty care brands in China market.

First, rationally lay out offline channels and online channels.

Today, counters in high-end shopping malls are still a form of highlighting the high-end image of brands, and beauty collection stores provide lower-cost options for offline contact with users, which are not essentially different from those of a few years ago. However, the e-commerce channel represented by Tmall has undergone drastic changes in the past decade.

First of all, the e-commerce channel not only has a distribution function, but also can reshape the brand image in the form of planting grass with content.

Secondly, ten years ago, Tmall Mall may still be full of low-priced goods, but after several high-end beauty care brands settled in the form of official flagship stores in 2014-2016, a large number of users have become accustomed to Tmall buying high-end beauty care products.

For example, a single 99 yuan Fulifang silk small-size facial cleanser is clearly separated from the 20-30 yuan facial cleanser price band dominated by traditional daily chemical brands;

The price of Whoo Hou Tian Qi Dan water emulsion set above 1000 yuan is even higher than that of high-end brands such as Estee Lauder;

The price of a single piece is more than 500 yuan’s fragrant green Deya small-sized three-phase essence, and the price is comparable to that of French luxury brand Cashi.

For mid-to high-end consumer goods brands, which channels are more in line with brand value positioning now and in the future? Which channels can achieve a high input-output ratio of brand marketing expenses? What role do different channels play in the precipitation of brand influence? These are undoubtedly important issues that brands need to explore through big data insight.

Second, the key to seize the opportunity of China’s e-commerce market is the refined operation driven by data.

The China market is complex and changeable, and it is often difficult for overseas brands to cope with it. According to the research of iResearch, compared with local brands, overseas brands are more inclined to hire local e-commerce operators in China, and the cooperation is stable.

This cooperation allows overseas brands to focus on product research and development, while the agent operators can quickly respond to market changes, improve sales performance and promote the break-up and sustainable development of overseas brands in the China market because they are familiar with the rules and operational logic of e-commerce platforms.

The core competitiveness of agency companies lies in efficient marketing and sales capabilities, which is also the key to effectively control the traffic cost of e-commerce platforms.

As the cost of obtaining customers for e-commerce platforms increases year by year, the voice of e-commerce "the bottom of the flow dividend" is endless. However, the facts show that the marketing cost in the station has not increased with the rapid growth of sales of Fulifang Silk, Whoo Hou and Fulu Deya, which has a lot to do with the professional digital and refined operation of the operation team.

As far as more than 60 brands cooperated by Beauty and Beauty Cosmetics are concerned, methods such as creating explosive products, attracting new users with small-sized products, and using platform tools to realize refined crowd operation are generally adopted in the operation process of many brands. Behind these operational strategies are the day-to-day mining of network big data by front-line employees to middle and senior managers and the continuous optimization of brand strategy.

Third, the rapid growth of sustainable development can only be achieved by continuous innovation around the brand core value positioning.

Only by strengthening the communication between the brand and new and old users can we build a consumer mind that can support the brand. Optimizing the traffic conversion rate and effectively raising the premium is an indispensable means to maintain the brand value image.

Tmall brand mental index(NEO)And the corresponding brand power diagnosis model provide an effective e-commerce data diagnosis method for brands.

Innovation index is the first of the three dimensions. However, due to factors such as the choice of similar brands in the industry and the difference in statistical caliber of data, how to combine user behavior and store strategy to obtain innovative insights from data diagnosis is the direction that brands need to constantly think and optimize.

Fu Lu Deya’s NEO innovation index is high, which may be a support point for its high-speed growth stage. For Fridays, the NEO index suggests that the brand innovation index is low.

Combined with the characteristics of Japanese product research and development, brand control in China, and cooperation with the operation team, this data insight reflects the shortcomings that have been neglected in brand development, and provides a decision-making basis for the operation team to adjust its strategy in time and strengthen innovation to cope with market changes.

Poster of performance season, source: Tianqiao Theater

Poster of performance season, source: Tianqiao Theater Elizabethan Kokoleva, Chief Ballet of the Bolshoi Theatre in Russia, performed in GALA. Source: Tianqiao Theater.

Elizabethan Kokoleva, Chief Ballet of the Bolshoi Theatre in Russia, performed in GALA. Source: Tianqiao Theater.