The countdown to Tesla FSD’s entry into China is the key to the sales break.

On the night of April 27th, Tesla CEO Musk boarded a private jet in gulfstream G550 for Beijing.

There is a dark cloud hanging over his mind-Tesla’s global sales growth has slowed down, Zachary Kirkhorn, vice president of finance who has been with him for more than 10 years, and Drew Baglino, senior vice president of power engineering, have left one after another, and this month, Tesla announced that it will lay off more than 10% of its employees worldwide, affecting tens of thousands of employees.

The sales dilemma needs to be reversed urgently. The Mexican factory has made slow progress, and the Indian factory is still far away. Although the competitors in the China market are fierce as wolves, the sales in China account for one-third of Tesla’s global sales, and the Shanghai factory also contributes nearly half of Tesla’s production capacity. Musk has undoubtedly found an emergency plan to save the current dilemma.

36Kr learned that Musk was going to China with Lars Moravy, vice president of vehicle engineering, and Zhu Xiaotong, senior vice president of automobile business. Lars is considered by Tesla employees to be about to replace Drew Baglino, and he and Zhu Xiaotong are obviously Musk’s right-hand men at the moment. Lars went to the Shanghai factory, while Musk stayed in Beijing.

Most of the projects are progressing smoothly. On the day of Musk’s visit to China, Tesla Model 3 and Model Y passed the four compliance requirements of automobile data security, and the ban on parking and driving will be lifted, which obtained the most basic road passes for the large-scale application of FSD in China market.

Since then, the news that Tesla is about to launch FSD in China has spread like wildfire. Before the US stock market opened on April 29th, Tesla’s share price rose by over 12%.

This is a rare share price rise of Tesla this year. In the past three months, Tesla’s share price has fallen by more than 40%, and its total market value was as low as $468.323 billion.

In 2018, Tesla suffered a productivity hell. After Musk visited China, Tesla Giga Shanghai completed the construction and put into production in just 10 months, helping Tesla out of the trough. At present, the status quo of Tesla is similar to that of six years ago. This time, can Tesla create miracles again?

FSD’s first-hand preparation for entering China

Tesla is not only a new energy car company, but also an AI company. The rapid development of Tesla AI technology is driven by technologies such as FSD(Full-Self Driving) and humanoid robot.

On the day of his arrival in China on April 28th, Musk said on the social platform that Tesla would invest about $10 billion this year for AI training and reasoning, and the AI reasoning was mainly used for cars. "Any company that spends less than $10 billion a year or is inefficient cannot participate in market competition."

But the more huge the investment, the more Tesla is eager to make profits with AI technology. In order to promote FSD, in March this year, Musk also sent an email to all employees, asking users to experience the FSD(Supervised) function when they test drive. In addition, Tesla also launched a one-month FSD free package experience to millions of users in North America.

With over 1.7 million owners, Tesla China is a market that FSD can’t miss. Tesla has been planning for the landing of FSD in China.

Cooperation with Baidu related map business is an important breakthrough for FSD to enter China. 36Kr learned from various sources that Tesla and Baidu have three cooperation in map business: car navigation map, advanced assisted driving map and compliance cloud.

"Baidu gave the version numbers of Tesla navigation map and Gaofu map respectively." Informed sources revealed.

Tesla owners are no strangers to Baidu car navigation maps. Since January 2020, Tesla has been equipped with Baidu navigation map on the car system.

In addition to navigation maps, the cooperation between Tesla and Baidu in advanced assisted driving maps and compliance clouds is even more critical, which has promoted the landing of FSD in China.

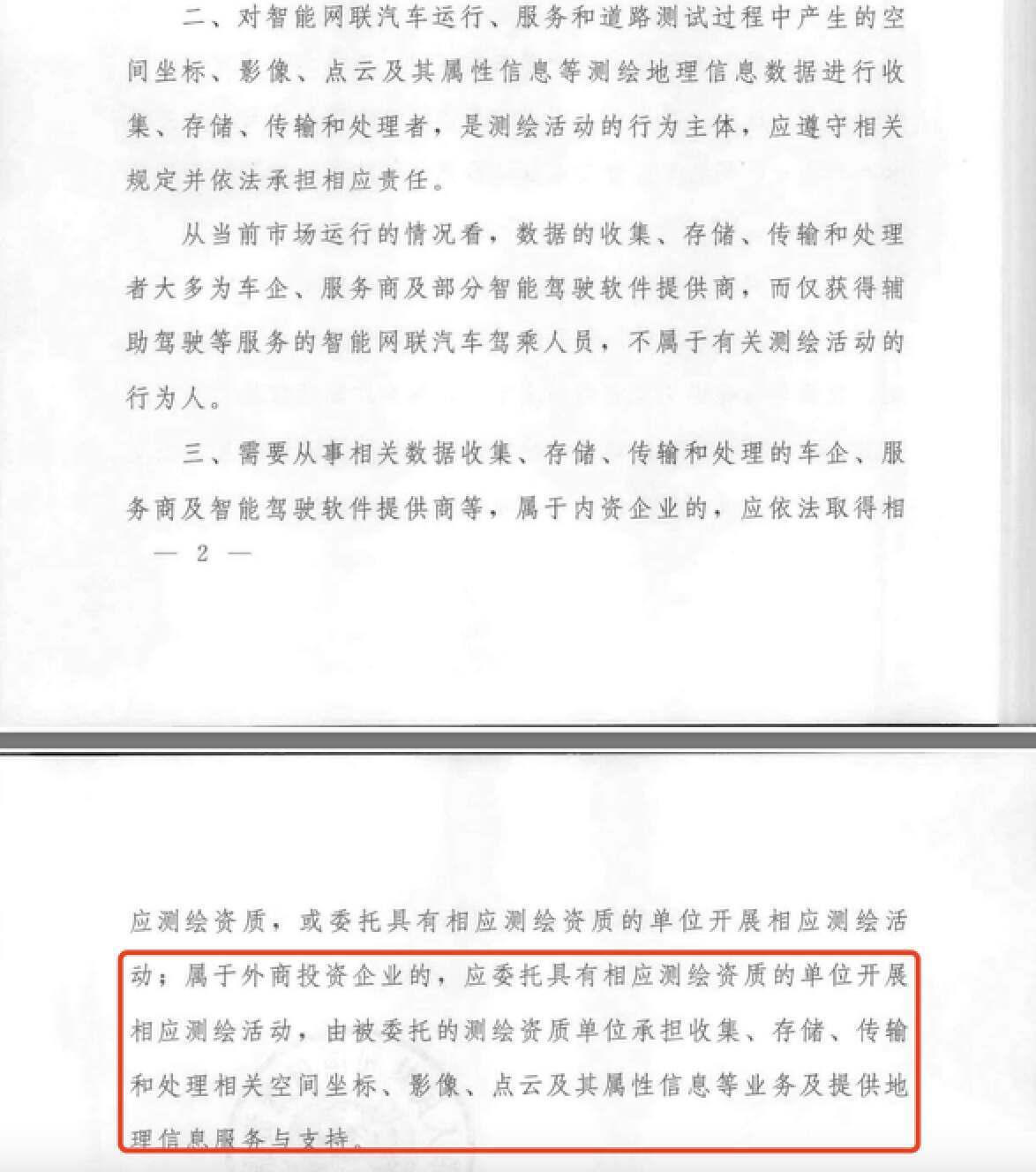

Previously, Tesla FSD had been facing a big compliance threshold when it entered China. According to the notice issued by the Ministry of Natural Resources in August, 2022, it is a surveying and mapping activity to collect road data by intelligent networked vehicles with cameras, lidar and other sensors. Foreign-invested enterprises must entrust enterprises with surveying and mapping qualifications to conduct surveying and mapping and process data.

In other words, Tesla, as a foreign-funded enterprise, needs to cooperate with a local enterprise with surveying and mapping qualifications in China, that is, a map manufacturer, in order to launch a smart car. Baidu Map is one of the 19 companies with Grade A map qualification in China, which meets the cooperation requirements of Tesla.

A person familiar with the matter told 36Kr that the cooperation reached between the two parties was "mainly the compliance processing of sensor data". Specifically, with the Grade A mapping qualification of Baidu map, the data collected by Tesla vehicle sensors need to be classified, coordinate deflected and desensitized on Baidu compliance cloud before they can flow to the automatic driving training.

Another person close to Baidu Map told 36Kr that the two parties started cooperation in December 2022, but before that, Tesla production vehicles had not passed the domestic automobile data security requirements, and the data compliance work of both parties was limited to Tesla test vehicles, which was not large in scale.

Tesla will be used for FSD model training and so on. According to 36Kr, Tesla-related autopilot data center has landed in Shanghai.

In addition, according to 36Kr’s previous report, Tesla has established a data labeling team and an operation team in China, and sent engineers from the US headquarters for training to promote the landing of FSD in the China market.

As the preparatory work draws to a close, Tesla is expected to open a business chapter of autonomous driving in China. According to 36Kr, at present, Tesla has over one million vehicles with FSD capability in China. However, it should be noted that if Tesla FSD function is used, users need to pay 64,000 yuan separately.

This price is far from touching people’s hearts. On the contrary, under the fierce domestic smart driving competition, at present, only Huawei’s high-level smart driving has started the user charging mode, and other car companies’ smart driving functions are basically free for users.

Tesla is also aware of the problem that FSD users are not willing to pay. In order to stimulate users, Tesla recently announced in the United States that the monthly subscription price of FSD has dropped from $199 to $99 per month; The buyout price of FSD also dropped from $12,000 to $8,000. Considering the domestic competitive environment, if Tesla FSD is further established in China, it may also adopt a monthly subscription model.

Tesla trams have been in China for 10 years, stirring the pattern and ecology of the domestic automobile industry with the attitude of catfish. It is another historic moment for Tesla to clear the obstacles when FSD enters China.

However, the domestic automobile market is far from that of ten years ago. Smart drivers such as Huawei, Tucki and Weilai are gearing up, and the industry competition is more full and players’ fighting spirit is stronger. It is difficult for Tesla’s FSD to be as fearless as when the tram entered China.

Tesla’s advantage chip may lie in the fact that FSD will not start too slowly in China with the massive data of millions of vehicles.

FSD, Tesla’s sales hope

The current Tesla is experiencing a new round of revenue crisis, and FSD may be the key to change its dilemma in the short term.

On April 24th, Tesla released its Q1 2024 financial report. During the reporting period, Tesla’s total revenue was $21.301 billion, and its revenue decreased by 9% year-on-year, which was lower than the market expectation of $22.3 billion.

Among them, the total automobile revenue was $17.378 billion, down 13% year-on-year, and GAAP operating profit was $1.2 billion, down 56% year-on-year. Accordingly, the gross profit decreased by 18% to US$ 3.696 billion.

The decline in sales is the main reason for the decline in Tesla’s revenue. According to the financial report data, in Q1 this year, Tesla produced 433,000 vehicles, down about 1.7% year-on-year, and delivered 387,000 vehicles, down about 8.3% year-on-year.

In order to change the current situation of sluggish sales, Tesla is taking several countermeasures.

On April 21st, Tesla China lowered the price of all products by 14,000 yuan, the price of Model 3 was reduced from 245,900-285,900 yuan to 231,900-271,900 yuan, and the price of Model Y was reduced from 263,900-368,900 yuan to 249,900-354,900 yuan. In the American market, Tesla also reduced the price of all products by $2,000.

However, since Tesla started several rounds of price cuts last year, its role in stimulating sales is close to failure. According to the data of the Federation, in the first quarter of this year, the retail volume of Tesla China was 132,420 vehicles, down 3.6% year-on-year.

In order to increase sales, Musk announced the production of low-priced models in advance, from the second half of 2025 to the end of 2024 or 2025. Compared with the new models that have not yet been put into production, the more mature FSD will be put on the market, or Tesla sales will be promoted faster.

According to the data of the Passenger Car Association, in 2023, the penetration rate of intelligent driving of L2 and above in China passenger car market reached 42.4%, and consumers’ recognition of intelligent driving was gradually increasing.

According to a person in the intelligent driving industry, the level of intelligent driving in China has developed rapidly in recent years. Although Tesla FSD has lost its technical advantage when it entered China, its technology and scenes have accumulated deeply. After training domestic data, the level of intelligent driving in will soon reach the domestic leading level.

"After the FSD comes in, the methodology of Tesla’s autonomous driving and AI infrastructure may also be learned by domestic companies." The above-mentioned person said.

At present, intelligent driving function is becoming one of the core selling points of new energy vehicles. Jin Yuzhi, CEO of Huawei’s smart car solution BU, once said that 70% of users in the world choose Huawei’s advanced smart driving package. LI has repeatedly stated that intelligent driving technology will be the core strategic goal in the future.

Tesla’s enhanced automatic assisted driving function sold in China has lagged behind the first echelon of intelligent driving in China, but after the introduction of FSD, Tesla can quickly make up for its lack of advanced intelligent driving ability.

The high-order intelligent driving function of China car companies mostly relies on multi-sensor schemes such as laser radar, and the high hardware cost leads to the application of more than 200,000 yuan.

Tesla adopts a low-cost pure visual intelligent driving scheme, which can flexibly apply FSD function to different price models. This means that if Tesla successfully launches a low-priced model and combines existing products, Tesla will realize the high-level intelligent driving function for the model of 100,000-300,000 yuan. Tesla will grab the market cake from its competitors in China by playing with low-priced models and high-level intelligent driving functions.

On this basis, with price reduction measures, Tesla, which still has room for price reduction, will have both technical and price advantages, which can further expand the market share of new energy vehicles.

Nowadays, Tesla’s FSD seems to be only one foot away from China, and this will be the card for Tesla to return to the first echelon of sales and open the gap with its opponents.