Goods and services tax section

1. I am a citizen, and I have some shops for rent. At the end of the year, I will charge a one-time rent of 12 months. Can I enjoy the VAT exemption policy?

A: According to the Announcement of State Taxation Administration of The People’s Republic of China on the Exemption of Small-scale Taxpayers from VAT Collection and Management (No.5, 2021), since April 1, 2021, the rental income obtained by other individuals from renting out real estate in the form of one-off rent can be shared equally during the corresponding lease period, and the monthly rental income after sharing does not exceed 150,000 yuan, so it is exempt from VAT. Before April 1, 2021, the above-mentioned tax exemption standard is that the monthly rental income after apportionment does not exceed 100,000 yuan.

At the end of the year, you will receive 12 months’ rent in one lump sum, and the monthly rent after sharing will not exceed 150,000 yuan (the total rent will not exceed 1.8 million yuan), so you can enjoy the preferential policy of exempting small-scale taxpayers from value-added tax according to the above provisions.

2. Our company is a pharmaceutical manufacturer, and its main business is pharmaceutical manufacturing, accounting for more than 90% of the company’s sales. Since 2019, our company has enjoyed the policy of returning 60% of the incremental retention. We are concerned that the country has newly introduced a stronger tax refund policy for advanced manufacturing industries. Can our company enjoy it?

A: According to the Announcement of the Ministry of Finance and the State Administration of Taxation on Defining the Tax Refund Policy for Advanced Manufacturing Industry at the End of Value-added Tax (No.15, 2021), since April 1, 2021, eligible advanced manufacturing taxpayers can apply to the competent tax authorities for a full refund of the incremental tax credit from May 2021 and beyond. Taxpayers in advanced manufacturing industries refer to those who have produced and sold nonmetallic mineral products, general equipment, special equipment, computers, communications and other electronic equipment, medicines, chemical fibers, railways, ships and aviation within 12 consecutive months before applying for tax refund (if the operating period before applying for tax refund is less than 12 months but more than 3 months, according to the actual operating period).

If the sales volume of "medicine" produced and sold by your company exceeds 50% of the total sales within 12 consecutive months before applying for tax refund, and at the same time meet other tax refund conditions stipulated in Announcement No.15, such as the tax credit rating of A and B, etc., the advanced manufacturing tax refund policy can be applied according to the provisions of Announcement No.15. No longer subject to the condition that the incremental tax allowance for six consecutive months is greater than zero and the incremental tax allowance for the sixth month is greater than 500,000 yuan, the tax refund ratio will be increased from 60% to 100%.

Income tax section

1. What preferential policies can qualified small and micro enterprises and individual industrial and commercial households enjoy in income tax?

A: According to the Announcement of the Ministry of Finance and the State Administration of Taxation on Implementing Preferential Income Tax Policies for Small and Micro Enterprises and Individual Industrial and Commercial Households (Announcement No.12 of the Ministry of Finance and the State Administration of Taxation in 2021), from January 1, 2021 to December 31, 2022, the portion of the annual taxable income of small and micro-profit enterprises that does not exceed 1 million yuan will be listed in the Notice of the Ministry of Finance and the State Administration of Taxation on Implementing Inclusive Tax Relief Policies for Small and Micro Enterprises (Cai Shui [2019]) On the basis of the current preferential policies, individual income tax will be levied by half for the part of individual industrial and commercial households whose annual taxable income does not exceed 1 million yuan.

2. When the enterprise income tax is paid in advance in October 2021, which enterprises can enjoy the preferential policy of R&D expenses plus deduction, and what is the deduction ratio?

A: According to the Notice of State Taxation Administration of The People’s Republic of China Ministry of Science and Technology of the Ministry of Finance on Perfecting the Pre-tax Addition and Deduction Policy for Research and Development Expenses (Caishui [2015] No.119), enterprises other than tobacco manufacturing, accommodation and catering, wholesale and retail, real estate, leasing and business services and entertainment can enjoy it.

3. What percentage can be deducted from the actual R&D expenses incurred by an enterprise in developing R&D activities?

A: If the actual R&D expenses incurred by an enterprise in R&D activities do not form intangible assets and are included in the current profits and losses, during the period from January 1, 2018 to December 31, 2023, on the basis of actual deduction according to regulations, 75% of the actual amount will be deducted before tax; Where intangible assets are formed, they shall be amortized before tax according to 175% of the cost of intangible assets during the above period. Announcement of the Ministry of Finance and the State Administration of Taxation on Further Improving the Pre-tax Plus Deduction Policy for R&D Expenses (No.13, 2021) raised the plus deduction ratio of R&D expenses in manufacturing industry to 100%.

4. When 10 corporate income taxes are paid in advance in 2021, during which period can eligible R&D expenses actually occur enjoy tax deduction?

A: Enterprises that pay in advance on a monthly basis will enjoy tax concessions plus or minus the eligible R&D expenses actually incurred from January to September 2021, and enterprises that pay in advance on a quarterly basis will enjoy tax concessions plus or minus the eligible R&D expenses actually incurred from January to March 2021.

V. Confirmation of special additional deduction information

(1) Case 1

If there is no change in the special additional deduction information in 2022, it only needs to be confirmed on the basis of 2021. ① Open the homepage of personal income tax App, select Learn About it or special additional deduction to fill in, select one-click to bring in, and then select deduction year 2022.

② According to the prompt, "The information of 2021 will be brought in. Are you sure whether to continue?" Or "You have special additional deduction information in 2022. If you continue to confirm, you will overwrite the existing special additional deduction information! " Click OK after confirmation.

③ Open the special additional deduction in the status to be confirmed, and check the information: if there is any modification, you can click Modify, and then click one button to confirm after the information is confirmed. (Note: If there is any information in "Invalid" status, you need to delete it before you can click "Confirm with One Button") ④ Click "Confirm with One Button" and the information will be submitted successfully. After confirmation, users can click on the home page in the App, select special additional deduction to fill in, select deduction year 2022 to view the submitted information, and if there is any change, they can choose to void or modify it.

(2) Case 2

In 2022, it is necessary to modify the information that has been filled in.

For example, if you need to modify the declaration method, deduction ratio and related information, you need to click to be confirmed and enter the relevant modification page to modify it. The following situations need to modify the special deduction information: I want to modify the deduction ratio of interest on supporting the elderly, children’s education and housing loans in 2022;

(III) Situation III

In 2022, special additional deductions need to be abolished.

For example, an elderly person died in 2021, and in 2022, he can no longer apply for a special additional deduction for supporting the elderly; Click on the information of supporting the elderly in the status to be confirmed, click Delete, and click one button to confirm.

(4) Situation 4

In 2022, special additional deductions need to be added. For example, in 2022, the new children’s education deduction needs to be declared and filled out.

First, confirm the other special additional deduction information that does not need to be modified according to the first step of the situation, and then click the App homepage to fill in the special additional deduction.

(5) Situation 5

In 2022, special additional deductions were filled in for the first time.

You can fill in the information by directly selecting the special additional deduction on the home page.

Property and Behavior Tax Section

1. What types of taxes are mainly referred to in the implementation of consolidated tax returns for property and behavior taxes? What are the specific provisions?

A: In order to continuously optimize the tax business environment and effectively reduce the burden of enterprise declaration, according to the Notice of the State Administration of Taxation and other thirteen departments on Several Measures to Promote the Reform of Tax Payment Facilitation and Optimize the Tax Business Environment (No.48 [2020] of Tax Administration), with the consent of State Taxation Administration of The People’s Republic of China, the Anhui Provincial Taxation Bureau of State Taxation Administration of The People’s Republic of China decided to implement the consolidated tax declaration of property and behavior taxes, with the specific taxes as follows: from December 1, 2020, When taxpayers declare and pay one or more taxes of urban land use tax, property tax, vehicle and vessel tax, stamp duty, cultivated land occupation tax, resource tax, land value-added tax, deed tax, environmental protection tax and tobacco tax, they shall use the Property and Behavior Tax Tax Declaration Form.

Taxpayers can declare through Anhui Electronic Taxation Bureau.

Specific content:

1. Since January 1, 2021, taxpayers who declare urban land use tax, property tax, land value-added tax, stamp duty and resource tax on schedule shall declare and pay taxes quarterly, and taxpayers shall declare and pay taxes within 15 days from the end of the quarter.

2. This announcement shall come into force as of December 1, 2020. Environmental protection tax returns issued by Announcement of State Taxation Administration of The People’s Republic of China on Issuing Tax Returns for Environmental Protection Tax (No.7, 2018) and tobacco tax returns issued by Announcement of State Taxation Administration of The People’s Republic of China on Issuing Tax Returns for Tobacco Leaf Tax (No.39, 2018), Stamp duty tax return issued by Announcement of State Taxation Administration of The People’s Republic of China on Local Taxes of Small-scale VAT Taxpayers and Relevant Additional Reduction Policies (No.5, 2019) and farmland occupation tax tax return issued by Announcement of State Taxation Administration of The People’s Republic of China on Relevant Matters Concerning the Collection and Management of Farmland Occupation Tax (No.30, 2019), The urban land use tax and real estate tax declaration form issued by State Taxation Administration of The People’s Republic of China Announcement on Revising the Declaration Form of Urban Land Use Tax and Real Estate Tax (No.32, 2019) and the resource tax declaration form issued by State Taxation Administration of The People’s Republic of China Announcement on Several Issues Concerning the Collection and Management of Resource Tax (No.14, 2020) are no longer used.

Second, how is the deed tax subsidy policy for rural hukou villagers to buy houses in Bozhou city?

A: According to Article 3 of Opinions of Bozhou Municipal Committee of the Communist Party of China on Promoting Migrant Workers’ Employment in Cities (Trial) (Bofa [2016] No.12): "Migrant workers who are employed in cities outside urban planning areas will be fully subsidized by the beneficiary finance according to the deed tax paid." From October 27, 2016 to October 26, 2017, they are eligible. After that, those who meet the requirements and purchase for another year until October 26, 2018 can enjoy subsidies. The catalogue module of "Deed Tax Subsidies for Migrant Workers to Purchase Houses in Cities" of Anhui Government Service Network or the window of municipal government service can apply for it. Specific procedures:

First, the applicant applies online.

Second, the planning department accepts and determines whether the applicant’s household registration is outside the planning area and whether the purchased house is within the planning area.

Third, the public security department determines whether the applicant is a rural resident.

Fourth, the tax department determines whether it is the first suite according to the deed tax payment, and approves the deed tax subsidy amount.

Fifth, the real estate registration department determines whether the real estate registration has been carried out.

Sixth, the real estate registration department issued a subsidy to the applicant to complete the cash.

Third, how to determine the time to buy a house?

Answer: When an individual purchases a house, the time indicated on the house title certificate or deed tax payment certificate obtained is taken as the time when he purchases the house. When a taxpayer declares, he/she will issue a house property right certificate and a deed tax payment certificate at the same time, and the time indicated by them is inconsistent, and the time for purchasing the house shall be determined according to the principle of "which comes first".

4. What are the preferential policies for individuals to purchase housing deed tax?

A: For individuals to purchase houses, the deed tax is levied at 1.5% for the 90-square-meter houses that are the only houses in the family, at 2% for the second set of improved houses, and at 3% for the third and above houses. The purchase of housing is less than 90 square meters, and the deed tax is levied at 1% for the first suite and the second suite, and at 3% for the third and above houses.

5. How is the applicable tax standard for the occupation of cultivated land in our province stipulated?

A: The applicable tax standard for cultivated land occupied by our province: for the first-class areas, the applicable tax standard is 37.5 yuan/square meter; For the second-class areas, the applicable tax standard is 26.25 yuan/square meter; For the third-class areas, the applicable tax standard is 18.75 yuan/square meter.

Occupation of basic farmland, according to the local applicable tax, plus 150% levy, the per capita arable land is less than 0.5 acres of areas temporarily not additional farmland occupation tax.

For those who occupy garden land, woodland, grassland, farmland water conservancy land, aquaculture water surface, fishery water beach and other agricultural land, the farmland occupation tax will be reduced by 20% according to the local applicable tax standard. Specific applicable tax standard: For Class I areas, the applicable tax standard is 30 yuan/square meter; For the second-class areas, the applicable tax standard is 21 yuan/square meter; In the third category, the applicable tax standard is 15 yuan/m2.

6. The Deed Tax Law of People’s Republic of China (PRC) came into effect on September 1, 2021, and Article 3 stipulated that the deed tax rate was 3%-5%. Compared with the previous 1% or 2% house purchase, did the deed tax rate increase?

A: On August 11th, the 13th the National People’s Congress Standing Committee (NPCSC) passed the Deed Tax Law of People’s Republic of China (PRC) (hereinafter referred to as the Deed Tax Law), which came into effect on September 1st, 2021. Article 3 of the Deed Tax Law stipulates that the deed tax rate is 3% to 5%. Many citizens heard this news and thought that after the implementation of the Deed Tax Law, the tax rate of deed tax rose. In fact, this is a misunderstanding.

The Deed Tax Law is the same as the "3%-5%" tax rate stipulated in the Provisional Regulations on People’s Republic of China (PRC) Deed Tax issued by the State Council in 1997, and the Deed Tax Law has not adjusted the tax rate. At present, citizens buy the only family housing and the second improved housing, and the preferential tax rate is implemented. In 2016, the Ministry of Finance, State Taxation Administration of The People’s Republic of China and the Ministry of Housing and Urban-Rural Development jointly issued the Notice on Adjusting the Preferential Policies for Deed Tax Business Tax in Real Estate Transactions (Caishui [2016] No.23), which stipulates that:

1, for individuals to buy the only family housing (family members including buyers, spouses and minor children), the area of 90 square meters and below, at a reduced rate of 1% deed tax; If the area is more than 90 square meters, the deed tax shall be levied at a reduced rate of 1.5%;

2, the second set of improved housing for families, with an area of 90 square meters or less, will be subject to deed tax at a reduced rate of 1%; If the area is more than 90 square meters, the deed tax shall be levied at a reduced rate of 2%.

The tax rates of 1%, 1.5% and 2% belong to preferential tax policies, which are applicable in most provinces in China, and Anhui has been implementing them all the time. That is to say, citizens have been enjoying preferential deed tax policies when buying the only family house and the second improved house, which does not conflict with the statutory tax rates stipulated in the Deed Tax Law.

Social security non-tax department

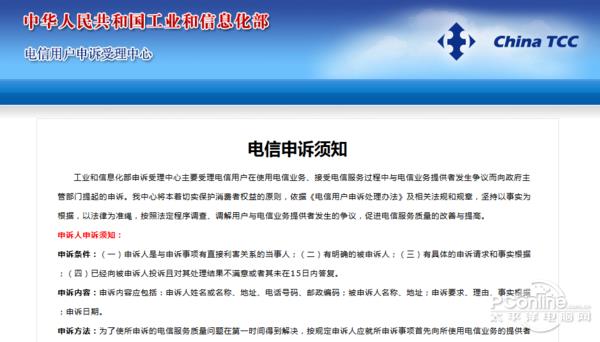

1. Some netizens consulted: I heard that the tax and social security payment for flexible employees and urban and rural residents can be realized in the palm of your hand. Would you please tell us how to operate the specific process?

A: Recently, the Provincial Taxation Bureau, the Provincial Department of Human Resources and Social Security, and the Provincial Medical Insurance Bureau jointly issued a notice. Since 0: 00 on January 1, 2021, the tax authorities have enabled the new system to handle social insurance premium payment business. After the system goes online, in order to facilitate flexible employees and urban and rural residents to pay fees, flexible employees and urban and rural residents can pay social insurance premiums through the related entrances of Wanshitong, WeChat and Alipay, or through the counters of commercial banks such as Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, China Construction Bank, Huishang Bank, Bank of Communications, Anhui Agricultural Bank, Postal Savings Bank, etc., and go to the tax service hall of the local tax authorities to handle the payment business (the unit payer can still log in to the electronic tax bureau to declare and pay).

Take WeChat payment operation as an example:

Open WeChat and click the applet in the discovery section;

Enter "Anhui Tax and Social Security Payment" in the search box, and "Anhui Tax and Social Security Payment" will appear at the bottom of the search box. Click to enter;

Click "I want to pay" on the home page to jump to the page of binding mobile phone number, and click on the one-button binding of mobile phone number (the first payment should be bound, and the second payment is not needed);

Click "Allow" on the pop-up page, and click "I want to pay" again after the binding is successful;

Enter the social insurance payment processing page, fill in the identity information in turn, enter the payer’s ID number and name, click "Next" to confirm and check the insurance information, and click "Next";

Click "Submit" to confirm the payment information, and click "Confirm Payment".

Click "Allow" and click "Confirm and Pay".

After the payment is completed, the WeChat payment can be completed, and the social security fee can be paid without leaving home, which is very fast. You are welcome to choose the payment channel suitable for you to pay social insurance premiums.

2. Some netizens asked: Since July 1, 2021, the non-tax revenue collection and management responsibilities such as land transfer fees and land idle fees have been transferred to the tax authorities for collection, especially the land transfer fees, which have a large income scale and a high degree of social concern. Please tell us about any changes before and after the transfer.

A: According to the decision of the CPC Central Committee and the State Council, from July 1, 2021, the land idle fee, land transfer fee, special income of mineral resources and urban garbage disposal fee collected by housing and urban and rural construction departments will be transferred to the tax authorities for collection.

This transfer is different from the collection subject, collection process, declaration and invoicing, warehousing and returning to the warehouse, and other policies such as collection scope, collection object, collection standard, reduction, sharing, use and management continue to be implemented in accordance with the existing regulations (no change).

For land transfer fees, the tax authorities shall collect them according to the principle of territoriality. The Provincial Taxation Bureau and the Provincial Department of Natural Resources jointly issued the work flow of land transfer fee collection: after the bidder and the natural resources department sign the transfer contract, the natural resources department will push the contract, the payment period, and the information table of the fee source of Anhui State-owned land use right transfer income to the tax department through the province’s non-tax revenue interconnection platform within 3 working days, and the tax department will collect and put it into storage according to the fee source information table pushed by the natural resources department.

Involving the bid bond, after the signing of the transfer contract, the bid bond account management unit will offset the bid bond as the land transfer fee, and declare and pay it to the tax authorities on behalf of the bidder within the prescribed time limit. The remaining amount shall be declared and paid by the bidder (payer) within the prescribed time limit according to the Notice of Payment issued by the tax department, and the tax department shall issue a payment voucher for the bidder (payer) to handle the follow-up matters. The bidder (payer) can declare and pay through the tax window of the government service hall, the tax service hall or the electronic tax bureau. It is convenient for the tax authorities to provide various payment methods such as three-party agreement online deduction, third-party code scanning payment, POS card swiping, bank transfer, cash and so on.

Collection management section

1. Hello, I’d like to ask about the application for deferred tax payment by enterprises. What information do enterprises need to apply for deferred tax payment now? How long can I apply for deferred tax payment? How long will it take to approve the application for deferred tax payment? Do you need to add a late fee if the audit fails? Thank you.

A: Hello! In accordance with the relevant provisions of the Tax Administration Law and the detailed rules for its implementation, if the taxpayer’s current monetary funds are insufficient to pay taxes after deducting the wages and social insurance premiums payable to employees, he may apply for an extension of tax payment before the expiration of the payment period. You can apply through the electronic tax bureau or go to the tax hall, and provide the following information: the application form for tax administrative license, the identity certificate of the agent and the statements of all bank deposit accounts. If you entrust others to handle it, you need to submit the power of attorney and the identity certificate of the agent. An enterprise applying for deferred tax payment shall not exceed three months at the longest, counting from the date when the original payment period for deferred tax payment expires. Examination and approval within 20 working days after acceptance. If the approval is not passed, a late fee will be charged from the date when the statutory tax payment period expires.

The above questions and answers are based on the Law of People’s Republic of China (PRC) on Tax Collection and Management, the Detailed Rules for the Implementation of the Law of People’s Republic of China (PRC) on Tax Collection and Management, and the Announcement of State Taxation Administration of The People’s Republic of China on Further Simplifying the Procedures for Handling Tax Administrative Licensing Matters (State Taxation Administration of The People’s Republic of China Announcement No.34, 2019).

No.2 taxation branch bureau

1. Do I need to purchase new commercial housing online? If so, where do you apply and what information do you need? When can I pay taxes and get the real estate license?

In order to facilitate the people to do things and ensure the service concept of getting things done without leaving home, it is necessary to pay the deed tax for the newly-built commercial housing purchased online. First, enter http://bz.ahzwfw.gov.cn/ or Baidu to search Bozhou Branch Office of Anhui Government Service Network, select the Municipal Bureau of Land and Resources in the department window, and click "Online bid for new commercial housing transaction and real estate registration" on the second page or directly search "Online bid for new commercial housing transaction and real estate registration" in the search bar. Upload the corresponding materials according to the prompt information of uploading materials.

The required materials include purchase invoice, purchase contract, ID card of the purchaser, household registration book, marriage certificate or unmarried certificate, real estate certificate or real estate registration certificate (master certificate of development company), all of which need to be photographed and uploaded in the corresponding column. Just upload the information once and share it with multiple departments. After the upload is successful, wait for approval, and after receiving the SMS reminder of tax payment (fee), pay the fee in the user center-My Payment-Business to be Paid. After the taxpayer signs and confirms, the process of "obtaining the certificate" can be completed in five working days.

Two, migrant workers to enjoy the deed tax subsidy policy, the main points that need to be paid attention to are as follows:

According to the relevant documents of the municipal government, migrant workers who purchase housing for the first time in cities must meet six preconditions: (1) the purchaser must be a rural hukou; (2) The registered permanent residence or original residence must be outside the urban planning area; (3) If there is no housing in the city under the name of family members, the house purchase is the first suite; (4) The first suite purchased must be residential; (5) The housing area must be below 144 square meters; (6) You must pay the deed tax in full first, and do a good job in real estate registration certificate before you can enjoy the preferential subsidy policy for deed tax; (7) The purchase date must be from October 27th, 2016 to October 27th, 2018.

Note: the deed tax subsidy for migrant workers’ first purchase in cities is handled from Anhui government service online.

Third, how to apply for deed tax subsidies for migrant workers in cities

Eligible personnel can log on to the Anhui Provincial Government Service Network, enter the deed tax subsidy module for migrant workers to buy houses in cities, fill in personal information and submit it. After submitting the application, the Municipal Public Security Bureau, the Taxation Bureau, the Planning Bureau and the real estate registration center will conduct pre-examination, which will be accepted by the Municipal Bureau of Land and Resources after approval, and the real estate registration center will issue funds after acceptance.

4. How to handle the invoicing by individuals? What do you need to bring?

A natural person needs to bring his original ID card and bank card to open an ordinary VAT invoice, which can be handled at the tax service hall or postal agency. After receiving the notice from the superior, the tax policy of individual invoicing will continue to be implemented temporarily according to the policy during the epidemic, and the value-added tax will be levied at a rate of 1%.

5. What information do I need to open an invoice for personal housing lease? Where can I make out an invoice?

You need to bring the original and photocopy of the house lease contract, the original and photocopy of the house real estate registration certificate (commercial house sales contract is provided without the house real estate registration certificate), the copy of the landlord’s ID card, and the copy of the business license with three certificates in one if the lessee is an enterprise. At present, this business has been implemented in the same city, and taxpayers can handle business in the nearest tax office according to their own conditions.

6. Can a newly-established enterprise apply for tax registration online now?

Sure. At present, there are two ways to deal with tax registration online: one is to log in to Anhui government service network, switch to Bozhou city, integrate services in the enterprise at the bottom of the page, and select the enterprise start-up module to confirm tax information; Second, it is handled in Anhui Electronic Taxation Bureau, and online processing can be realized by selecting one photo and one yard for household registration information confirmation.

7. Can foreigners pay vehicle purchase tax in Bozhou?

Car owners whose registered permanent residence is not in Bozhou (including three counties and one district) need to pay vehicle purchase tax in Bozhou, and they must first apply for a residence permit in the Public Security Bureau before they can pay vehicle purchase tax in Bozhou.

Eight, vehicle purchase tax exemption scope

New energy vehicles (including pure electric vehicles and hybrid electric vehicles) should be exempted from vehicle purchase tax according to national policies; Overseas students who return to China to serve will be exempted from car purchase tax if they buy a domestic car.

9. What information do international students need to be exempted from car purchase tax when they return to China to serve and buy a domestic car?

1. Certificate of foreign academic degree

2. Approved by the Customs "Quasi-purchase Form for Returned Persons to Buy Domestic Cars"

3. Passport

4. Certificate of returned overseas students

Bring the above information to the window of the city car purchase tax service hall to apply for exemption.

X. How to pay taxes on second-hand housing transactions?

There are mainly the following three situations:

(a) the date of the real estate license or the date of the deed tax payment certificate is less than two years.

Seller: the value-added tax is 5%, the surcharge is levied by half according to the tax reduction and fee reduction policy (the policy time is from January 1, 2019 to December 31, 2021), and the personal income tax is 1%;

(two) the date of the real estate license or the date of the deed tax payment certificate is two years but less than five years.

Seller: Individual income tax 1%

(3) If the date indicated in the real estate license or the deed tax payment certificate has reached five years and the property is the only residence of the seller, the seller shall be exempted from personal income tax.

For the buyer, the above behaviors are as follows: 1.5% deed tax will be levied on the house over 90 square meters purchased by individuals as the only house in the family, 2% deed tax will be levied on the second improved house, and 3% deed tax will be levied on the third and above houses; The purchase of housing is less than 90 square meters, and the deed tax is levied at 1% for the first suite and the second suite, and at 3% for the third and above houses.

XI. How to pay taxes on the transaction of second-hand facade houses?

Seller: (verification method): 5% of value-added tax, 50% of surcharge according to the policy of tax reduction and fee reduction (the policy time is from January 1, 2019 to December 31, 2021), 5% of land value-added tax, 1% of personal income tax and five ten thousandths of stamp duty; (Non-approved method): Due to the need to provide invoices, tax stamps and other related materials to prove the original value of the property, at the same time, the land value-added tax rate is different under different circumstances.

Buyer: pay deed tax of 3%; Stamp duty is five ten thousandths.

12. What tax-related matters can be handled in the same city and in the whole province?

As for the tax-related business that taxpayers often care about, which tax office can handle it, at present, except the deed tax paid by the first-hand house, the transfer tax paid by the second-hand house and the vehicle purchase tax, it needs to be handled in the professional tax office, and other tax-related businesses have basically been handled in the same city and the whole province. Taxpayers can handle the business in the nearest tax service office according to their own conditions. Please refer to Announcement No.18, 2018 of State Taxation Administration of The People’s Republic of China Anhui Provincial Taxation Bureau on General Administration of Taxation Matters in the Same City and in the Province for details of general administration of business.

XIII. Some taxpayers reported that the deed tax had been paid for a long time, but when they asked about the handling of the real estate license by the Real Estate Bureau, they learned that the deed tax had not been paid to the tax authorities.

After preliminary verification, it was found that the taxpayer had paid the deed tax and public maintenance fund fees to the real estate developer before he got the keys to buy the house, and the developer paid them on his behalf. As the developer delayed the payment, the taxpayer mistakenly thought that the deed tax had been paid to the tax department, which led to inquiries and complaints. In view of this kind of situation, we will do a good job in explaining and coordinating for taxpayers.