Double 11 Tmall’s order failed to let UnionPay lie down, Alipay: the engineer wrote wrong English.

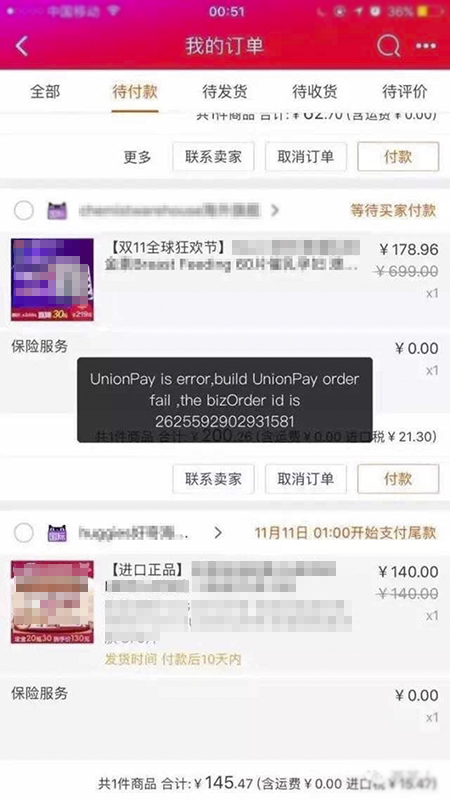

During the rush hour of "double 11" in the early morning, many users created orders, and some users reported "UnionPay is error" on Taobao Tmall client, which made netizens think that this was a failure of UnionPay system.

Some users reported errors in Taobao Tmall client. The picture comes from the Internet.

At noon on November 11th, Alipay, which has a delicate relationship with UnionPay, took the initiative to come forward and issued a statement saying: This error report really has nothing to do with UnionPay.

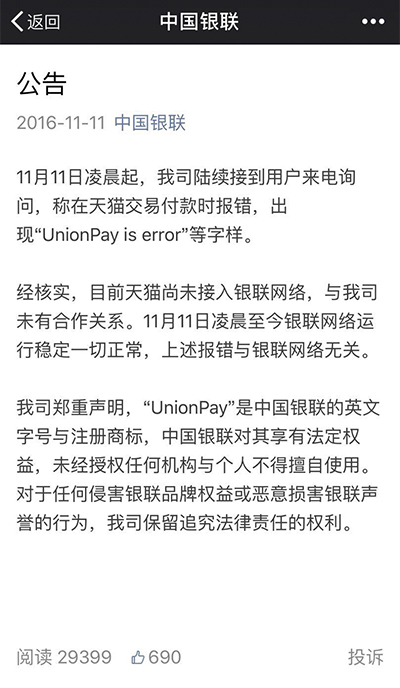

UnionPay subsequently issued a statement saying that Tmall has not yet connected to the UnionPay network and has no cooperative relationship with our company. Since the early morning of November 11th, the UnionPay network has been running stably and everything is normal. The above-mentioned error has nothing to do with the UnionPay network.

UnionPay issued a statement.

In the early hours of the morning, this error has been fixed.

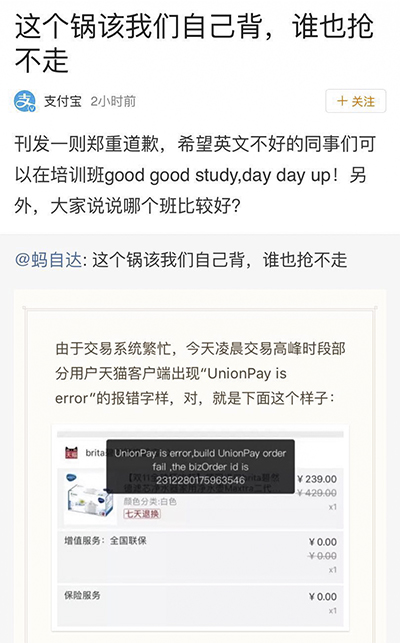

The manager of Alipay’s public relations department explained in Weibo that this English prompt is an error code defined by Taobao engineers themselves, which means "consolidated payment failed and the creation of consolidated payment order failed." According to feedback from colleagues with good English, the English for combined payment is "combined payment" instead of "unionpay", which is the Taobao engineer’s mistake in writing English.

A statement issued by Alipay.

"The error chart appears in the process of combining payment orders, that is, the process of submitting orders, but it has not yet reached the stage of payment." Alipay internal staff told The Paper.

"This unintentional mistake has had a bad influence on UnionPay, and all our colleagues apologize. We won’t throw this black pot to anyone, please fasten it firmly on our heads. " Alipay statement said.

Although it was not Alipay’s problem, Alipay quickly clarified that the reason was that during the user payment process, Alipay established contacts with many banks, pocketed the receipt and transfer business, and directly bypassed the UnionPay transfer platform.

Alipay, as a third-party payment company, can talk to the bank point to point, and does not need UnionPay to connect, and the interface of online payment rates, prices and policies does not need UnionPay to provide. As far as online payment is concerned, UnionPay is parallel to other payment institutions. In short, it is more flexible to connect with banks by bypassing UnionPay.

Earlier, some analysts said that Alipay even broke the business model that UnionPay had maintained for more than ten years. The mode of UnionPay is bill collection-transfer-liquidation, but the mode of direct connection between Alipay and banks saves the transfer with UnionPay.

It is worth noting that UnionPay also solemnly declared that "UnionPay" is the English name and registered trademark of China UnionPay, and China UnionPay enjoys legal rights and interests to it, and no organization or individual may use it without authorization. We reserve the right to pursue legal responsibility for any act that infringes upon the brand rights and interests of UnionPay or maliciously damages the reputation of UnionPay.

At 0: 9: 39 in the morning of November 11th, Alipay reached a payment peak of 120,000 transactions per second, and mobile payment accounted for 92%. At 1: 06 a.m., Alipay paid 200 million transactions, exceeding the 188 million transactions in double 11 in 2013. As of 12 noon on the 11th, the number of transactions of Alipay consumer credit product "Ant Flower Flower" has exceeded 96 million, an increase of over 110% year-on-year, making it one of the most popular payment methods in double 11.

Different from previous years, this year’s "double 11" consumer finance battlefield is even more full of smoke.

Ant Financial, the parent company of Alipay, has been fully deployed in the fields of consumer credit and insurance since September, and its consumer credit product Ant Flower Garden announced that it can apply for a temporary increase in the quota during the "double 11" period; JD.COM wants to open up the functions of its various financial products through this "double 11". Jingdong Finance upgraded its consumer credit products in mid-October: that is, it can get a credit line of 30,000 yuan through the opening of white bars in JD.COM Treasury; This year, Qihoo 360′ s financial business also joined the battle for the first time. The first personal credit product, 360 IOUs, has been launched, with a maximum quota of 200,000, which is intended to grab the big cake of "double 11" consumer finance.